UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant | x | |

Filed by a Party other than the Registrant | o | |

Check the appropriate box: | |

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-12 |

Washington Real Estate Investment Trust |

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x | No fee required. |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) | Title of each class of securities to which transaction applies: | |

2) | Aggregate number of securities to which transaction applies: | |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

4) | Proposed maximum aggregate value of transaction: | |

5) | Total fee paid: | |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) | Amount Previously Paid: | |

2) | Form, Schedule or Registration Statement No.: | |

3) | Filing Party: | |

4) | Date Filed: | |

| 1775 Eye Street, N.W. Suite 1000 Washington, D.C. 20006 202-774-3200 www.washreit.com |

April 9, 2020

Dear Shareholder,

You are cordially invited to attend the Annual Meeting of Shareholders of Washington Real Estate Investment Trust, a Maryland real estate investment trust (“Washington REIT,” the “Company,” “we” or “us”), to be held on Thursday, May 28, 2020 at 8:30 a.m., Eastern Time (the “Annual Meeting”). The Annual Meeting will be held in virtual meeting format only. We are excited to embrace the environmentally-friendly virtual meeting format, which we believe will enable increased shareholder attendance and participation. During this virtual meeting, you will be able to vote your shares electronically and submit questions. The accompanying Notice of 2020 Annual Meeting of Shareholders and Proxy Statement describe the proposals to be considered and voted upon at the Annual Meeting.

The Board of Trustees of Washington REIT (the “Board”) has nominated seven individuals for election as trustees at the Annual Meeting and recommends that shareholders vote in favor of their election. In addition to the election of the trustees, we are recommending your approval of our executive compensation program in a non-binding, advisory vote. We are also recommending your ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020.

Regardless of the number of shares you own, your vote is important. Please read the Proxy Statement carefully, then complete, sign and return your Proxy Card in the enclosed envelope. You may also authorize a proxy to vote via telephone or the Internet if you prefer by following instructions on the Proxy Card.

The Board appreciates your continued support of Washington REIT and encourages your participation in the Annual Meeting. Whether or not you plan to virtually attend the Annual Meeting, it is important that your shares be represented. Accordingly, please vote your shares as soon as possible.

Sincerely, | |

/s/ Paul T. McDermott | |

Paul T. McDermott | |

Chairman of the Board | |

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Shareholders to be held on Thursday, May 28, 2020

This Proxy Statement and our 2019 Annual Report to Shareholders

are available at http://www.edocumentview.com/wre.

WASHINGTON REAL ESTATE INVESTMENT TRUST

NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Washington Real Estate Investment Trust:

Notice is hereby given that the Annual Meeting of Shareholders of Washington Real Estate Investment Trust, a Maryland real estate investment trust (“Washington REIT,” “we” or “us”), will be held at the time and place below and for the following purposes:

Date: | Thursday, May 28, 2020 |

Time: | 8:30 a.m., Eastern Time |

Place: | You can virtually attend the Annual Meeting at http://www.meetingcenter.io/266660104. |

Record Date: | The trustees have fixed the close of business on March 17, 2020, as the record date for determining holders of shares entitled to notice of, and to vote at, the Annual Meeting or at any postponement or adjournment thereof. |

Items of Business: | 1. To elect seven trustees to serve on the Board; 2. To consider and vote on a non-binding, advisory basis upon the compensation of the named executive officers as disclosed in the Proxy Statement pursuant to Item 402 of Regulation S-K; 3. To consider and vote upon ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020; and 4. To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

Proxy Voting: | You are requested, whether or not you plan to virtually attend the Annual Meeting, to vote, sign and promptly return the Proxy Card. Alternatively, you may authorize a proxy to vote by telephone or the Internet, if you prefer. To do so, you should follow the instructions on the Proxy Card. |

Regardless of the number of shares you hold, as a shareholder your role is very important, and the Board strongly encourages you to exercise your right to vote. Pursuant to the U.S. Securities and Exchange Commission’s “notice and access” rules, our Proxy Statement and 2019 Annual Report to Shareholders are available online at www.edocumentview.com/wre.

By order of the Board of Trustees: | |

/s/ Taryn D. Fielder | |

Taryn D. Fielder | |

Corporate Secretary | |

Washington, D.C. | |

April 9, 2020 | |

TABLE OF CONTENTS | |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | |

PROPOSAL 1: ELECTION OF TRUSTEES | |

Description of Proposal | |

Voting Matters | |

Recommendation | |

CORPORATE GOVERNANCE AND BOARD MATTERS | |

Board Composition | |

Trustees | |

Board Governance | |

Committee Governance | |

Trustee Nominee Consideration | |

Other Governance Matters | |

2019 Trustee Compensation | |

2020 Trustee Compensation | |

Executive Officers | |

PRINCIPAL AND MANAGEMENT SHAREHOLDERS | |

Trustee and Executive Officer Ownership | |

5% Shareholder Ownership | |

PROPOSAL 2: ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION | |

Description of Proposal | |

Voting Matters | |

Recommendation | |

COMPENSATION DISCUSSION AND ANALYSIS | |

CD&A Executive Summary | |

Say-On-Pay Results and Consideration | |

Compensation Objectives and Components | |

Role of Compensation Consultant and Peer Group Analysis | |

Role of Executives | |

Base Salary | |

Short-Term Incentive Plan (STIP) | |

Long-Term Incentive Plan (LTIP) | |

2020 Compensation Decisions | |

Other Executive Compensation Components | |

Policies Applicable to Executives | |

Tax Deductibility of Executive Compensation | |

Compensation Committee Matters | |

Compensation Consultant Matters | |

Compensation Policies and Risk Management | |

Compensation Committee Interlocks and Insider Participation | |

Compensation Committee Report | |

i

COMPENSATION TABLES | |

Summary Compensation Table | |

Total Direct Compensation Table | |

Grants of Plan-Based Awards | |

Outstanding Equity Awards at Fiscal Year-End | |

2019 Option Exercises and Stock Vested | |

Supplemental Executive Retirement Plan | |

Potential Payments upon Change in Control | |

CEO Pay Ratio | |

PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

Description of Proposal | |

Voting Matters | |

Recommendation | |

ACCOUNTING/AUDIT COMMITTEE MATTERS | |

Principal Accounting Firm Fees | |

Pre-Approval Policies and Procedures | |

Audit Committee Report | |

OTHER MATTERS | |

Solicitation of Proxies | |

Shareholder Proposals for Our 2021 Annual Meeting of Shareholders | |

Annual Report | |

ii

| 1775 Eye Street, N.W. Suite 1000 Washington, D.C. 20006 202-774-3200 www.washreit.com |

April 9, 2020

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why am I receiving this Proxy Statement?

This Proxy Statement is furnished by the Board of Trustees (the “Board” or “Board of Trustees”) of Washington Real Estate Investment Trust, a Maryland real estate investment trust (“Washington REIT,” “we” or “us”), in connection with its solicitation of proxies for exercise at the 2020 Annual Meeting of Shareholders to be held as a virtual meeting (at http://www.meetingcenter.io/266660104) on Thursday, May 28, 2020, at 8:30 a.m., Eastern Time, and at any and all postponements or adjournments thereof (the “Annual Meeting”). This Proxy Statement, our 2019 Annual Report (the “Annual Report”), and the Proxy Card are first being made available, and the Important Notice Regarding the Availability of Proxy Materials (the “Proxy Availability Notice”) is first being mailed to shareholders of record as of March 17, 2020 (the “Record Date”) on or about April 9, 2020.

The Proxy Statement and Annual Report, as well as our shareholder letter, will also be available at http://www.edocumentview.com/wre. The mailing address of our principal executive offices is 1775 Eye Street N.W., Suite 1000, Washington, D.C. 20006. We maintain a website at www.washreit.com. Information on or accessible through our website is not and should not be considered part of this Proxy Statement.

You should rely only on the information provided in this Proxy Statement. No person is authorized to give any information or to make any representation not contained in this Proxy Statement, and, if given or made, you should not rely on that information or representation as having been authorized by us. You should not assume that the information in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement or, where information relates to another date set forth in this Proxy Statement, then as of that date.

Why didn’t I automatically receive a paper copy of the Proxy Card and Annual Report?

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials via the Internet. Accordingly, rather than paper copies of our proxy materials, we are sending a Notice of Internet Availability of Proxy Materials (the "Proxy Notice") to our shareholders that provides instructions on how to access our proxy materials on the Internet.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will be asked to vote upon the matters set forth in the accompanying notice of annual meeting, including the election of trustees, an advisory resolution on named executive officer compensation, the ratification of the appointment of our independent registered public accounting firm and such other business as may properly come before the meeting or any postponement or adjournment thereof.

May I attend the meeting?

All shareholders of record of common shares (as defined below) at the close of business on the Record Date, or their designated proxies, may attend the Annual Meeting, vote and submit questions, equivalent to in-person meetings of shareholders, by visiting http://www.meetingcenter.io/266660104.

After years of declining attendance by shareholders at Washington REIT’s in-person annual meetings, we are moving to an online format for this year’s Annual Meeting. This virtual meeting of shareholders allows shareholders the ability to more easily attend the Annual Meeting without incurring travel costs or other inconveniences.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most current version of applicable software and plugins. Participants should ensure that they have a strong internet or WiFi connection wherever they intend to participate in the Annual Meeting. Participants should also allow themselves plenty of time to login and ensure that they can hear audio prior to the start of the Annual Meeting.

At any time before or during the meeting, participants may submit questions by logging into the virtual meeting at http://www.meetingcenter.io/266660104 and clicking on the dialog icon in the upper right corner of the meeting center screen.

2

How do I attend and vote shares at the Annual Meeting?

Attending the Meeting for Shares Registered Directly in the Name of the Shareholder

If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting. Please follow the instructions on the notice or proxy card that you received.

Attending the Meeting for Shares held in “Street Name”

If you hold your shares in “street name” (i.e., your shares are held in an account maintained by a bank, broker or other nominee), you must register in advance to attend the Annual Meeting.

To register to attend the Annual Meeting you must submit proof of your proxy power (legal proxy) reflecting your holdings in Washington REIT along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time, on May 22, 2020.

You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

By email:

Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail:

Computershare

Washington REIT Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Why hold a virtual Annual Meeting?

At Washington REIT, we embrace the latest technologies in our business and believe that holding our Annual Meeting virtually not only provides expanded access and improves our communication with shareholders, but also yields cost savings. In deciding to move our meeting online this year, we considered a number of factors, including the technologies available to us, the historical level of shareholder attendance in person (generally less than five each year), and the cost of holding our Annual Meeting in person. In addition, due to the public health impact of the coronavirus outbreak, holding a virtual Annual Meeting

3

is especially important this year to protect the health and well-being of our stockholders. We plan to evaluate annually the method of holding the Annual Meeting, taking into consideration the above factors as well as business and market conditions and the proposed agenda items.

Who is entitled to vote at the Annual Meeting?

The close of business on March 17, 2020 has been fixed as the Record Date for the determination of shareholders entitled to receive notice of, and to vote at, the Annual Meeting. Our voting securities consist of common shares of beneficial interest, $0.01 par value per share (“common shares”), of which 82,297,369 common shares were outstanding at the close of business on the Record Date. Washington REIT has no other outstanding voting security. Each common share outstanding as of the close of business on the Record Date will be entitled to one vote on each matter properly submitted at the Annual Meeting.

What constitutes a quorum?

The presence of shareholders in person via attendance at the virtual Annual Meeting or by proxy entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting on any matter will constitute a quorum at the Annual Meeting. Shareholders do not have cumulative voting rights. Abstentions and broker non-votes, if any, are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the virtual Annual Meeting. A “broker non-vote” occurs when a broker properly executes and returns a proxy card, but does not vote on a matter because the broker does not have discretionary authority to vote the shares on that matter and has not received voting instructions from the beneficial owner. Brokers may vote those shares only on matters deemed “routine” by the New York Stock Exchange (the “NYSE”), the exchange on which our common shares are listed. On non-routine matters, brokers holding shares for a beneficial owner are not entitled to vote without instructions from the beneficial owner.

Proposal 3 (Ratification of Ernst & Young LLP) is the only proposal to be voted upon at the Annual Meeting that is considered “routine” under the NYSE rules. Accordingly, no broker non-votes will arise in the context of voting for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020, and the broker is permitted to vote your shares on such ratification even if the broker does not receive voting instructions from you. The treatment of abstentions and broker non-votes and the vote required to approve each proposal are set forth under the caption “Voting Matters” under each proposal below.

4

How do I authorize a proxy to vote my shares?

Voting by Proxy for Shares Registered Directly in the Name of the Shareholder

If you are a “registered shareholder” and hold your common shares in your own name as a holder of record with our transfer agent, Computershare Trust Company, N.A., you may instruct the proxy holders named in the Proxy Card how to vote your common shares in one of the following ways:

• | Vote by Internet. You may authorize a proxy to vote via the Internet by following the instructions provided on your Proxy Card. The website for Internet voting is printed on your Proxy Card. To authorize a proxy to vote your common shares online, you will be asked to enter your control number(s) to ensure the security of your vote. You will find your control number on your Proxy Card received with your Proxy Statement. If you vote by Internet, you do not need to return your Proxy Card. |

• | Vote by Telephone. You also have the option to authorize a proxy to vote by telephone by calling the toll-free number listed on your Proxy Card. When you call, please have your Proxy Card in hand. You will receive a series of voice instructions that will allow you to authorize a proxy to vote your common shares. You will also be given the opportunity to confirm that your instructions have been properly recorded. If you vote by telephone, you do not need to return your Proxy Card. |

• | Vote by Mail. If you received printed materials, and would like to authorize a proxy to vote your common shares by mail, then please mark, sign and date your Proxy Card and return it promptly to our transfer agent, Computershare Trust Company, N.A., in the postage-paid envelope provided. If you did not receive printed materials and would like to vote by mail, you must request printed copies of the proxy materials by following the instructions on the Proxy Availability Notice. |

Voting by Proxy for Shares held in “Street Name”

If your common shares are held in “street name” (i.e., through a broker, bank or other nominee), then you will receive instructions from your broker, bank or other nominee that you must follow in order to have your common shares voted. The

5

materials from your broker, bank or other nominee will include a Voting Instruction Form or other document by which you can instruct your broker, bank or other nominee how to vote your common shares.

What am I being asked to vote on?

You are being asked to consider and vote on the following proposals:

• | Proposal 1 (Election of Trustees) - page 8 below: To elect seven trustees to the Board to serve until the Annual Meeting of Shareholders in 2021 and until their successors have been duly elected and qualify. |

• | Proposal 2 (Advisory Vote on Named Executive Officer Compensation) - page 34 below: To consider and vote on a non-binding, advisory basis upon the compensation of the named executive officers as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K (“Say-on-Pay vote”). |

• | Proposal 3 (Ratification of Appointment of Ernst & Young LLP) - page 83 below: The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020. |

We are not currently aware of any other matter to be presented at the Annual Meeting other than those described in this Proxy Statement. If any other matter not described in the Proxy Statement is properly presented at the Annual Meeting, any proxies received by us will be voted in the discretion of the proxy holders.

What are the Board’s voting recommendations?

The Board recommends that you vote as follows: FOR the election of the trustee nominees listed on the Proxy Card, FOR approval of the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, and FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. All properly executed proxies will be voted in accordance with the instructions contained therein. If no instructions are specified, proxies will be voted in accordance with the Board’s recommendations above. All proxies will be voted in the discretion of the proxy holders on any other matter that may be properly brought before the Annual Meeting.

6

What is householding?

If you and other residents at your mailing address own common shares in street name, your broker, bank or other nominee may have sent you a notice that your household will receive only one Annual Report, Notice of Annual Meeting and/or Proxy Statement, unless you have instructed otherwise. This procedure, known as “householding,” is intended to reduce the volume of duplicate information shareholders receive and also reduce our printing and postage costs. If you wish to request extra copies, we will promptly deliver a separate copy of such documents to shareholders who write or call us at the following address or telephone number: Washington Real Estate Investment Trust, 1775 Eye Street, N.W., Suite 1000, Washington, D.C. 20006, Attention: Investor Relations; telephone 202-774-3200. Shareholders wishing to receive separate copies of our Proxy Statement and Annual Report in the future, or shareholders currently receiving multiple copies of the Proxy Statement and Annual Report at their address who would prefer that only a single copy of each be delivered there, should contact their bank, broker or other nominee record holder.

May I change my vote after I have voted?

Yes, you may revoke your proxy at any time prior to its exercise at the Annual Meeting by (1) submitting a duly executed Proxy Card bearing a later date to the Corporate Secretary, (2) voting electronically during the Annual Meeting at http://www.meetingcenter.io/266660104, or (3) delivering a signed notice of revocation of the Proxy Card to our Corporate Secretary at the following address: c/o Corporate Secretary, Washington Real Estate Investment Trust, 1775 Eye Street, N.W., Suite 1000, Washington, D.C. 20006. If your common shares are held by a broker, bank or any other persons holding common shares on your behalf, you must contact that institution to revoke a previously authorized proxy. Virtual attendance at the Annual Meeting without voting online will not itself revoke a proxy.

Whom should I call if I have questions or need assistance voting my shares?

Please call (800) 565-9748 or email info@washreit.com if you have any questions in connection with voting your shares.

7

PROPOSAL 1: ELECTION OF TRUSTEES

Description of Proposal

Our shareholders voted to declassify our Board at the 2017 annual meeting of Shareholders. The last three-year term within the Board expired during the 2019 Annual Meeting of Shareholders. All members of the Board are now elected annually. Benjamin S. Butcher, William G. Byrnes, Edward S. Civera, Ellen M. Goitia, Paul T. McDermott, Thomas H. Nolan, Jr., and Vice Adm. Anthony L. Winns (RET.) (collectively, the “Trustee Nominees”) have been nominated for election as trustees at the Annual Meeting. The Trustee Nominees will be elected to serve a one-year term and until his or her respective successor has been elected and qualifies or the trustee’s earlier resignation, death or removal.

Each of the Trustee Nominees is currently serving as a trustee and was recommended for nomination for re-election by the members of the Corporate Governance/Nominating Committee. For biographical information with respect to each Trustee Nominee, please refer to “Corporate Governance and Board Matters - Trustees - Trustee Nominees” commencing on page 10 below.

Voting Matters

Under our amended and restated bylaws, as amended (the “bylaws”), the uncontested election of each trustee requires the affirmative vote of a majority of the total votes cast for and against such trustee. A majority of votes cast means that the number of votes “FOR” a nominee must exceed the number of votes “AGAINST” that nominee. Abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of this vote.

If any of the Trustee Nominees becomes unable or unwilling to stand for election for any reason not presently known or contemplated, the persons named in the enclosed Proxy Card will have discretionary authority to vote pursuant to the Proxy Card for a substitute nominee nominated by the Board, or the Board, on the recommendation of the Corporate Governance/Nominating Committee, may reduce the size of the Board and number of nominees.

Recommendation

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF MESSRS. BUTCHER, BYRNES, CIVERA, MCDERMOTT, NOLAN AND WINNS AND MS. GOITIA.

8

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Composition

The Board currently consists of seven trustees. The current members of our Board are Benjamin S. Butcher, William G. Byrnes, Edward S. Civera, Ellen M. Goitia, Paul T. McDermott, Thomas H. Nolan, Jr., and Vice Adm. Anthony L. Winns (RET.). Mr. McDermott is currently serving as Chairman of the Board and Mr. Civera is currently serving as Lead Independent Trustee.

Trustees

The following table sets forth the names and biographical information concerning each of our trustee nominees.

NAME | PRINCIPAL OCCUPATION | SERVED AS TRUSTEE SINCE | AGE |

Trustee Nominees | |||

Benjamin S. Butcher | Chief Executive Officer, President and Chairman of the Board of Directors of STAG Industrial, Inc. | 2014 | 66 |

William G. Byrnes | Retired Managing Director, Alex Brown & Sons | 2010 | 69 |

Edward S. Civera | Retired Chairman, Catalyst Health Solutions, Inc. | 2006 | 69 |

Ellen M. Goitia | Retired Partner, KPMG | 2017 | 60 |

Paul T. McDermott | Chairman of the Board, President and Chief Executive Officer, Washington REIT | 2013 | 58 |

Thomas H. Nolan, Jr. | Former Chairman of the Board and Chief Executive Officer, Spirit Realty Capital Inc. | 2015 | 62 |

Vice Adm. Anthony L. Winns (RET.) | President, Latin America-Africa Region, Lockheed Martin Corporation | 2011 | 64 |

9

Trustee Nominees

The biographical description below for each Trustee Nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board that such person should serve as a trustee of Washington REIT.

Benjamin S. Butcher | Served as Trustee since 2014 | |

| Benjamin S. Butcher serves as the Chief Executive Officer, President and Chairman of the Board of Directors of STAG Industrial, Inc., a position he has held since July 2010. Prior to the formation of STAG Industrial, Inc., Mr. Butcher oversaw the growth of STAG Capital Partners, LLC and its affiliates, serving as a member of their Board of Managers and Management Committees, from 2003 to 2011. From 1999 to 2003, Mr. Butcher was engaged as a private equity investor in real estate and technology. From 1997 to 1998, Mr. Butcher served as a Director at Credit Suisse First Boston, where he sourced _ | |

and executed transactions for the Principal Transactions Group (real estate debt and equity). From 1993 to 1997, he served as a Director at Nomura Asset Capital, where he focused on marketing and business development for its commercial mortgage-backed securities group. Mr. Butcher brings the following experience, qualifications, attributes and skills to the Board: | ||

• | General business management and strategic planning experience from his service as chief executive of STAG Industrial, Inc. and his previous service with STAG Capital Partners, LLC and its affiliates; |

• | REIT industry experience from his service as chief executive of STAG Industrial, Inc. since July 2010; |

• | Real estate investment banking and capital markets experience from his five years as an investment banker with Credit Suisse First Boston and Nomura Asset Capital; and |

• | Financial and accounting acumen from his five years in investment banking, his experience as a private equity investor and with STAG Capital Partners, LLC, and his service as a public company executive with STAG Industrial, Inc. |

10

William G. Byrnes | Served as Trustee since 2010 | |

| William G. Byrnes has been a private investor since 2001. He was on the Board of Directors of CapitalSource Inc., a commercial lender operating principally through its subsidiary CapitalSource Bank from 2003 until its sale in April 2014, serving in various capacities including Presiding Independent Director, Chairman of the Audit Committee and, most recently, Chairman of the Board. He founded, and was Managing Member of, Wolverine Partners, LLC, that operated MUTUALdecision, a mutual fund research business, from September 2006 to October 2012. Mr. Byrnes was co-founder of Pulpfree ____ | |

d/b/a BuzzMetrics, a consumer-generated media research and marketing firm, and served as its Chairman from June 1999 until its sale in September 2005. He was on the Board of Directors and chairman of the Audit Committee of LoopNet, Inc., an information services provider to the commercial real estate industry, from September 2006 until its sale in April 2012. Mr. Byrnes spent 17 years with Alex Brown & Sons, most recently as a Managing Director and head of the investment banking financial institutions group. He has been a full-time and adjunct professor and member of the Board of Regents at Georgetown University and currently sits on its Entrepreneurship Advisory Group. Mr. Byrnes brings the following experience, qualifications, attributes and skills to the Board: | ||

• | Real estate investment banking and capital markets experience from his 17 years as an investment banker with Alex Brown & Sons; |

• | REIT industry experience from his involvement over the last 15+ years as an independent director of three publicly-traded REITs and an institutional fund focused on investing in REITs; |

• | Retail and residential real estate industry experience from his involvement as an independent director of Sizeler Property Investors from 2002 to 2006; |

• | Financial and accounting acumen from his 17 years in investment banking and his service as a public company director; and |

• | General familiarity with D.C. area real estate by virtue of living and working in the Washington, D.C./Baltimore corridor for more than 40 years. |

11

Edward S. Civera | Served as Trustee since 2006 | |

| Edward S. Civera served as the Chairman of the Board of Catalyst Health Solutions, Inc., a publicly traded pharmacy benefit management company (formerly known as HealthExtras, Inc.), from 2005 until his retirement in December 2011. In 2012, he served as a senior advisor to management and the Board of Directors of Catalyst Health Solutions in connection with the sale of the company. Mr. Civera also served as Chairman of the MedStar Health System, a multi-institutional healthcare organization, until his retirement from the board in November 2013. From 1997 to 2001, Mr. Civera was the Chief Operating _______ | |

Officer and Co-Chief Executive Officer of United Payors & United Providers, Inc. ("UP&UP"), a publicly-traded healthcare company that was sold in 2000. Prior to that, Mr. Civera spent 25 years with Coopers & Lybrand (now PricewaterhouseCoopers LLP), most recently as Managing Partner, focused on financial advisory and auditing services. Mr. Civera is a Certified Public Accountant. Mr. Civera brings the following experience, qualifications, attributes and skills to the Board: | ||

• | General business management and strategic planning experience from his ten years as a public company chief executive or chairman at UP&UP and Catalyst Health Solutions; |

• | REIT industry experience from his involvement as an independent director of The Mills Corporation from 2005 to 2006 leading its reorganization and sale as Chairman of the Special Committee and member of the Executive Committee; |

• | Executive and real estate industry experience from his involvement in real estate matters as Chairman of MedStar Health; |

• | Financial and accounting acumen from his 25 years in public accounting and his service as a public company executive; and |

• | General familiarity with D.C. area real estate by virtue of living and working in the Washington, D.C./Baltimore corridor for more than 25 years. |

12

Ellen M. Goitia | Served as Trustee since 2017 | |

| Ellen M. Goitia is a Certified Public Accountant and served as the partner-in-charge for KPMG LLP’s ("KPMG") Chesapeake Business Unit Audit practice and a member of the firm’s audit leadership team from October 2011 until her retirement in May 2016. As the partner-in-charge of the Chesapeake Business Unit Audit practice, Ms. Goitia had ultimate operational oversight for five offices in Maryland, DC and Virginia, with responsibilities including business unit financial performance, resource management, human resources, quality client service, and risk management. Ms. Goitia was admitted to the KPMG _ | |

partnership in 1993 and had more than 30 years of experience as a professional with the firm, including experience as lead audit partner for a variety of publicly traded and private companies. She has served clients on a wide range of accounting and operational issues, public security issuances and strategic corporate transactions. Ms. Goitia was a speaker, panelist and moderator for KPMG’s Audit Committee Institute as well as for other governance programs external to KPMG. In addition, Ms. Goitia served as an independent member of the Nominating Committee of KPMG’s Board of Directors from 2009 until 2011, and has served on several nonprofit organizations’ boards. Ms. Goitia brings the following experience, qualifications, attributes and skills to the Board: | ||

• | General business management and strategic planning experience from her 5 years as the partner-in-charge of the Chesapeake Business Unit Audit Practice of KPMG and over 30 years as a professional at KPMG; |

• | Understanding of and familiarity with public companies and public company boards from her service as lead audit engagement partner at a major accounting firm; |

• | Public company accounting, financial statements and corporate finance expertise from over 20 years of service as lead audit engagement partner at a major accounting firm; and |

• | General familiarity with D.C. area real estate by virtue of living and working in the Washington, D.C. region for more than 35 years. |

13

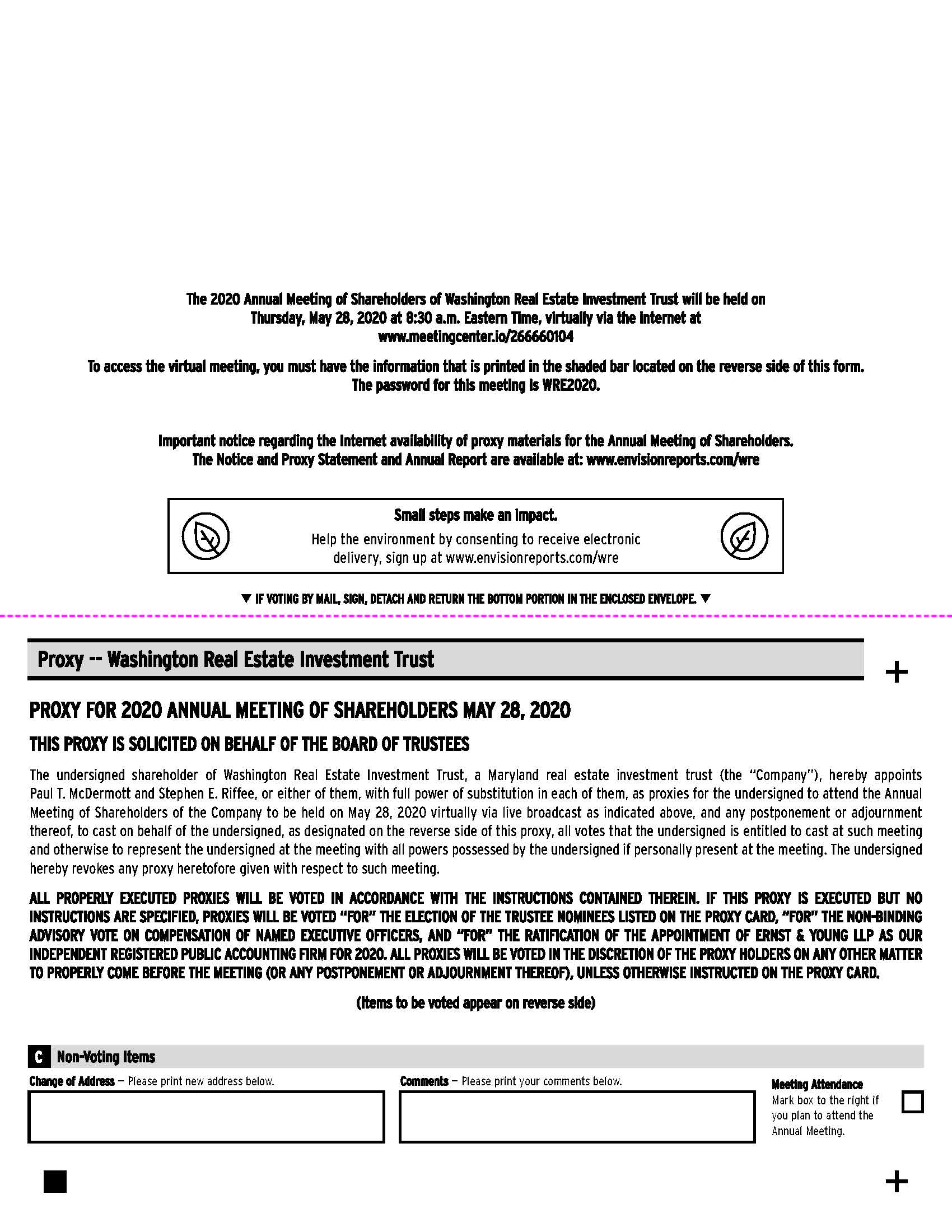

Paul T. McDermott | Served as Trustee since 2013 | |

| Paul T. McDermott was elected to the Board of Trustees and named President and Chief Executive Officer of Washington REIT in October 2013. Following the 2018 Annual Meeting, Mr. McDermott became the Chairman of the Board of Trustees of Washington REIT. Prior to joining Washington REIT, he was Senior Vice President and Managing Director for Rockefeller Group Investment Management Corp., a wholly owned subsidiary of Mitsubishi Estate Co., Ltd. from June 2010 to September 2013. Prior to joining Rockefeller Group, he served from 2006 to 2010 as Principal and Chief Transaction | |

Officer at PNC Realty Investors. Between 2002 and 2006, Mr. McDermott held two primary officer roles at Freddie Mac -- Chief Credit Officer of the Multifamily Division and Head of Multifamily Structured Finance and Affordable Housing. From 1997 to 2002, he served as Head of the Washington, D.C. Region for Lend Lease Real Estate Investments. Mr. McDermott brings the following experience, qualifications, attributes and skills to the Board: | ||

• | General business management and strategic planning experience from his service as chief executive of Washington REIT and his previous service as Senior Vice President of Rockefeller Group; |

• | Office, retail and residential real estate industry operating and investment experience from his experience as Senior Vice President of Rockefeller Group, Principal and Chief Transaction Officer at PNC Realty Investors and Chief Credit Officer of the Multifamily Division of Freddie Mac; |

• | Office and residential development experience from his experience as Head of Washington, D.C. Region for Lend Lease Real Estate Investments; and |

• | Extensive familiarity with D.C. area real estate by virtue of living and working in the Washington, D.C. region for more than 55 years. |

14

Thomas H. Nolan, Jr. | Served as Trustee since 2015 | |

| Thomas H. Nolan, Jr. previously served as Chairman of the Board of Directors and Chief Executive Officer of Spirit Realty Capital, Inc. (NYSE: SRC) from September 2011 until May 2017. Mr. Nolan previously worked for General Growth Properties, Inc. (“GGP”), serving as Chief Operating Officer from March 2009 to December 2010 and as President from October 2008 to December 2010. He also served as a member of the board of directors of GGP from 2005 to 2010. GGP filed for protection under Chapter 11 of the U.S. Bankruptcy Code in April 2009 and emerged from bankruptcy in November ___________ | |

2010._Mr. Nolan was a member of the senior management team that led GGP’s reorganization and emergence from bankruptcy, which included the restructuring of $15.0 billion in project-level debt, payment in full of all of GGP’s pre-petition creditors and the securing of $6.8 billion in equity commitments. From July 2004 to February 2008, Mr. Nolan served as a Principal and Chief Financial Officer of Loreto Bay Company, the developer of the Loreto Bay master planned community in Baja, California. From October 1984 to July 2004, Mr. Nolan held various financial positions with AEW Capital Management, L.P., a national real estate investment advisor, and from 1998 to 2004, he served as Head of Equity Investing and as President and Senior Portfolio Manager of The AEW Partners Funds. Mr. Nolan currently serves on the Board of Directors of RW Holdings NNN REIT. Mr. Nolan brings the following experience, qualifications, attributes and skills to the Board: | ||

• | General business management and strategic planning experience from his service as chief executive of Spirit Realty Capital, Inc. and his previous service with GGP; |

• | REIT industry experience from his service as chief executive of Spirit Realty Capital, Inc. and his previous service with GGP; |

• | Real estate asset management experience in multiple asset classes from his 20 years with AEW Capital Management, L.P.; and |

• | Financial and accounting acumen from his 20 years with AEW Capital Management, L.P. and his previous service with GGP and as chief executive of Spirit Realty Capital, Inc. |

15

Vice Adm. Anthony L. Winns (RET.) | Served as Trustee since 2011 | |

| Vice Adm. Anthony L. Winns (RET.) is President, Latin America-Africa Region, Lockheed Martin Corporation (“Lockheed”), a position he has held since January 2013. Between October 2011 and January 2013, Mr. Winns was Vice President, International Maritime Programs, at Lockheed. Between July 2011 and October 2011, Mr. Winns was a defense industry consultant. Mr. Winns retired in June 2011 after 32 years of service in the United States Navy. He served as Naval Inspector General from 2007 to his retirement. From 2005 to 2007, Mr. Winns served as Acting Director and Vice Director of Operations _ | |

on the Joint Chiefs of Staff. From 2003 to 2005, Mr. Winns served as Deputy Director, Air Warfare Division for the Chief of Naval Operations. Prior to 2003, Mr. Winns served in other staff and leadership positions in Washington, D.C., including at the Bureau of Naval Personnel. He also served as commanding officer of several major commands, including the Pacific Patrol/Reconnaissance task force, the USS Essex, an amphibious assault carrier, and a naval aircraft squadron. Mr. Winns also serves as a director on the board of the Navy Mutual Aid Association. Mr. Winns brings the following experience, qualifications, attributes and skills to the Board: | ||

• | General enterprise management and strategic planning experience from his 10 years of service as a commanding officer of various military units (including a naval vessel) and 11 years of service in senior staff positions in the Pentagon; |

• | Government contracting experience from his three years of service managing U.S. Navy procurement programs as Deputy Director, Air Warfare Division for the Chief of Naval Operations (Washington REIT is a federal contractor and many of Washington REIT’s largest tenants and potential future tenants are federal contractors); |

• | Washington, D.C. area defense industry experience from his 16 years of service in staff positions in the Pentagon and current service as President, Latin America-Africa Region, Lockheed Martin Corporation; and |

• | General familiarity with D.C. area real estate by virtue of living and working in the Washington, D.C. region for more than 25 years. |

16

Board Governance

Leadership Structure

The Board has concluded that Washington REIT should maintain a Board leadership structure in which either the Chairman or a lead trustee is independent under the rules of the NYSE. As a result, the Board adopted the following Corporate Governance Guideline setting forth this policy:

The Board annually elects one of its trustees as Chairman of the Board. The Chairman of the Board may or may not be an individual who is independent under the rules of the NYSE (and may or may not be the same individual as the Chief Executive Officer). At any time that the Chairman of the Board is not an individual who is independent under the rules of the NYSE, the Board will appoint a Lead Independent Trustee elected by the independent trustees. The current Chairman of the Board is the Chief Executive Officer and is not independent under the rules of the NYSE. Accordingly, the Board has appointed a Lead Independent Trustee. The Lead Independent Trustee has authority to: (i) preside at all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent trustees; (ii) serve as a liaison between the Chairman of the Board and the independent trustees; (iii) approve information sent to the Board; (iv) approve meeting agendas for the Board; (v) approve meeting schedules to assure that there is sufficient time for discussion of all agenda items; (vi) call meetings of the independent trustees; and (vii) if requested by major shareholders, consult and directly communicate with such shareholders.

The Board believes that the leadership structure described in our Corporate Governance Guidelines is appropriate because it ensures significant independent Board leadership regardless of whether the Chairman is independent under the rules of the NYSE. Currently, our Chairman of the Board, President and Chief Executive Officer is Paul T. McDermott, and Edward S. Civera serves as our Lead Independent Trustee.

The Board recognizes that one of its key responsibilities is to evaluate and determine the optimal leadership structure for the Board so as to provide independent oversight of management. The Board understands that there is no single generally accepted approach to providing Board leadership and the appropriate Board leadership structure may vary as circumstances warrant. Consistent with this understanding, our independent trustees periodically consider the Board’s leadership structure. The Board believes that combining the Chairman and Chief Executive Officer roles is an appropriate corporate governance

17

structure for Washington REIT at this time because it utilizes Mr. McDermott’s extensive experience and knowledge regarding Washington REIT’s business segments while still providing for effective independent leadership of our Board and Washington REIT through a Lead Independent Trustee.

Independence

Under NYSE rules, a majority of the Board must qualify as “independent.” To qualify as “independent,” the Board must affirmatively determine that the trustee has no material relationship with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with us).

The Board has determined that Trustee Nominees, with the exception of Mr. McDermott, and Mr. Nason, our former trustee, are “independent,” as that term is defined in the applicable NYSE listing standards.

Risk Oversight

One of the key functions of the Board is informed oversight of our risk management process. As an initial matter, the Board considers actual risk monitoring and management to be a function appropriately delegated to Washington REIT management, with the Board and its committees functioning in only an oversight role. Our Board administers this oversight function directly, with support from its three standing committees, the Audit Committee, Compensation Committee and the Corporate Governance/Nominating Committee, each of which addresses risks specific to its respective areas of oversight. The Board has adopted a policy delineating the roles of the Board and its various committees in an ongoing risk oversight program for Washington REIT, providing that:

• | the Board will coordinate all risk oversight activities of the Board and its committees, including appropriate coordination with Washington REIT’s business strategy; |

• | the Audit Committee will oversee material financial reporting risk and risk relating to REIT non-compliance; |

• | the Compensation Committee will oversee financial risk, financial reporting risk and operational risk, in each case arising from Washington REIT’s compensation plans; |

18

• | the Corporate Governance/Nominating Committee will oversee executive succession risk and Board function risk; and |

• | the Board will oversee all other material risks applicable to Washington REIT, including operational, cybersecurity, catastrophic and financial risks that may be relevant to Washington REIT’s business. |

Under its policy, the Board also involves the Audit Committee in its risk oversight functions as required by applicable NYSE rules.

Meetings

The Board held nine meetings in 2019. During 2019, each incumbent trustee attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings of all committees of the Board on which he or she served (during the periods that he or she served). Each of the seven incumbent members of the Board as well as Mr. Nason, the former lead independent trustee, attended the Annual Meeting in person in 2019. The Board does not have a formal written policy requiring trustees to attend the Annual Meeting, although trustees have traditionally attended.

Washington REIT’s trustees who qualify as “non-management” within the meaning of the NYSE rules meet at regularly scheduled executive sessions without management participation. The sessions are presided over by the Lead Independent Trustee. In 2019, the Board met in executive session without the Chairman, President and Chief Executive Officer six times.

19

Committee Governance

Our Board has three standing committees, an Audit Committee, a Compensation Committee and a Corporate Governance/Nominating Committee. The membership and the function of each of these committees are described below.

Audit | Compensation | Corporate Governance/Nominating | ||||

Benjamin S. Butcher | l | l | ||||

William G. Byrnes | l | l | ||||

Edward S. Civera | l | l | ||||

Ellen M. Goitia | Chair | l | ||||

Thomas H. Nolan, Jr. | l | Chair | ||||

Vice Adm. Anthony L. Winns | l | Chair | ||||

Number of meetings held during 2019 | 4 | 4 | 4 | |||

Audit Committee

All members of the Audit Committee are, and were during 2019, “independent” under NYSE rules. The Board has determined that each member of the Audit Committee qualifies as an audit committee financial expert, as that term is defined in the rules of the SEC.

The Audit Committee operates pursuant to a charter that was approved by the Board and that is reviewed and reassessed at least annually. The Audit Committee’s oversight responsibility includes oversight relating to: (i) the integrity of Washington REIT’s consolidated financial statements and financial reporting process; (ii) Washington REIT’s systems of disclosure controls and procedures, internal control over financial reporting and other financial information provided by Washington REIT; (iii) Washington REIT’s compliance with financial, legal and regulatory requirements; (iv) the annual independent audit of Washington REIT’s financial statements, the engagement and retention of the registered independent public accounting firm and the evaluation of the qualifications, independence and performance of such independent public accounting firm; (v) the performance of Washington REIT’s internal audit function; and (vi) the fulfillment of the other responsibilities of the Audit Committee set forth in its charter.

The Audit Committee assists the Board in oversight of financial reporting, but the existence of the Audit Committee does not alter the responsibilities of Washington REIT’s management and the independent accountant with respect to the accounting and control functions and financial statement presentation. For a more detailed description of the Audit Committee’s

20

duties and responsibilities, please refer to the “Audit Committee Report” below in this Proxy Statement. The Audit Committee’s charter is available on our website, www.washreit.com, under the heading “Investors” and subheading “Corporate Governance - Governance Documents,” and upon written request.

Compensation Committee

All members of the Compensation Committee are, and were in 2019, “independent” under NYSE rules. The Compensation Committee operates pursuant to a charter that was approved by the Board and that is reviewed and reassessed at least annually. The Compensation Committee’s responsibilities include, among other duties: (i) discharging responsibilities relating to compensation of Washington REIT’s Chief Executive Officer, other executive officers and trustees, taking into consideration, among other factors, any shareholder vote on compensation; (ii) implementing and administering Washington REIT’s compensation plans applicable to executive officers; (iii) overseeing and assisting Washington REIT in preparing the Compensation Discussion & Analysis for inclusion in Washington REIT’s proxy statement and/or Annual Report on Form 10-K; (iv) providing for inclusion in Washington REIT’s proxy statement a description of the processes and procedures for the consideration and determination of executive officer and trustee compensation; and (v) preparing and submitting for inclusion in Washington REIT’s proxy statement and/or Annual Report on Form 10-K a Compensation Committee Report.

The Compensation Committee’s charter is available on our website, www.washreit.com, under the heading “Investors” and subheading “Corporate Governance - Governance Documents,” and upon written request.

Corporate Governance/Nominating Committee

All members of the Corporate Governance/Nominating Committee are, and were in 2019, “independent” under NYSE rules. The Corporate Governance/Nominating Committee operates pursuant to a charter that was approved by the Board and that is reviewed and reassessed at least annually. The Corporate Governance/Nominating Committee’s responsibilities include, among other duties: (i) to identify and recommend to the full Board qualified candidates for election as trustees and recommend nominees for election as trustees at the annual meeting of shareholders consistent with criteria approved by the Board; (ii) to develop and recommend to the Board a set of corporate governance guidelines applicable to Washington REIT, and implement and monitor such guidelines as adopted by the Board; (iii) to oversee the Board’s compliance with financial, legal and regulatory requirements and its ethics program as set forth in Washington REIT’s Code of Business Ethics and Conduct; (iv) to review and

21

make recommendations to the Board on matters involving the general operation of the Board, including the size and composition of the Board and the structure and composition of Board committees; (v) to recommend to the Board nominees for each Board committee; (vi) to periodically facilitate the assessment of the Board’s performance, as required by applicable law, regulations and NYSE corporate governance listing standards; (vii) to oversee the Board’s evaluation of management; and (viii) to consider corporate governance issues that may arise from time to time and make recommendations to the Board with respect thereto.

The Corporate Governance/Nominating Committee’s charter is available on our website, www.washreit.com, under the heading “Investors” and subheading “Corporate Governance - Governance Documents,” and upon written request.

Trustee Nominee Consideration

Selection Process

The Corporate Governance/Nominating Committee’s process for the recommendation of trustee candidates is described in our Corporate Governance Guidelines. Set forth below is a general summary of the process that the Corporate Governance/Nominating Committee currently utilizes for the consideration of trustee candidates. The Corporate Governance/Nominating Committee may, in the future, modify or deviate from this process in connection with the selection of a particular trustee candidate.

• | The Corporate Governance/Nominating Committee develops and maintains a list of potential candidates for Board membership on an ongoing basis. Corporate Governance/Nominating Committee members and other Board members may recommend potential candidates for inclusion on such list. In addition, the Corporate Governance/Nominating Committee, in its discretion, may seek potential candidates from organizations, such as the National Association of Corporate Directors, that maintain databases of potential candidates. Shareholders may also put forward potential candidates for the Corporate Governance/Nominating Committee’s consideration by submitting candidates to the attention of the Corporate Governance/Nominating Committee at our executive offices in Washington, D.C. The Corporate Governance/Nominating Committee screens all potential candidates in the same manner regardless of the source of the recommendation. |

• | The Corporate Governance/Nominating Committee reviews the attributes, skill sets and other qualifications for potential candidates (as discussed below) from time to time and may modify them based upon the Corporate |

22

Governance/Nominating Committee’s assessment of the needs of the Board and the skill sets required to meet those needs.

• | When the Corporate Governance/Nominating Committee is required to recommend a candidate for nomination for election to the Board at an annual or special meeting of shareholders, or otherwise expects a vacancy on the Board to occur, it commences a candidate selection process by reviewing all potential candidates against the current attributes, skill sets and other preferred qualifications to determine whether a candidate is suitable for Board membership. This review may also include an examination of publicly available information and consideration of the NYSE independence requirements, the number of boards on which the candidate serves, the possibility of interlocks, other requirements or prohibitions imposed by applicable laws, regulations or Washington REIT policies and practices, and any actual or potential conflicts of interest. The Corporate Governance/Nominating Committee then determines whether to remove any candidate from consideration as a result of the foregoing review. Thereafter, the Corporate Governance/Nominating Committee determines a proposed interview list from among the remaining candidates and recommends such interview list to the Board. |

• | Following the Board’s approval of the interview list, the Chairman of the Corporate Governance/Nominating Committee or, at his or her discretion, other trustees, interview the potential candidates on such list. After the completion of candidate interviews, the Corporate Governance/Nominating Committee determines a priority ranking of the potential candidates on the interview list and recommends such priority ranking to the Board. |

• | Following the Board’s approval of the priority ranking, the Chairman of the Corporate Governance/Nominating Committee or, at his or her discretion, other trustees, contact the potential candidates based on their order in the priority ranking. When a potential candidate indicates his or her willingness to accept nomination to the Board, the recommendation process is substantially complete. Subject to a final review of eligibility under Washington REIT policies and applicable laws and regulations using information supplied directly by the candidate, the Corporate Governance/Nominating Committee then recommends the candidate for nomination. |

The Corporate Governance/Nominating Committee’s minimum qualifications and specific qualities and skills required for trustees are also set forth in our Corporate Governance Guidelines. Our Corporate Governance Guidelines currently provide that each trustee candidate, at a minimum, should possess the following attributes: integrity, trustworthiness, business judgment,

23

credibility, collegiality, professional achievement, constructiveness and public awareness. Our Corporate Governance Guidelines also provide that, as a group, the independent trustees should possess the following skill sets and characteristics: financial acumen equivalent to the level of a public company chief financial officer or senior executive of a capital market, investment or financial services firm; operational or strategic acumen germane to the real estate industry; public and/or government affairs acumen; corporate governance acumen, gained through service as a senior officer or director of a publicly-owned corporation or comparable academic or other experience; and diversity in terms of age, race, gender, ethnicity, geographic knowledge, industry experience and expertise, board tenure and culture. Additionally, our bylaws provide that no person shall be nominated for election as a trustee after his or her 72nd birthday, except under circumstances set forth in the bylaws.

Diversity Policy

The Board maintains a policy with regard to consideration of diversity in identifying trustee nominees. Consistent with this policy, the Corporate Governance/Nominating Committee specifically considers diversity as a factor in the selection of trustee nominees. The Board believes that the best decisions can be made when a variety of viewpoints contribute to the process. As noted above, the Board defines diversity in our Corporate Governance Guidelines in terms of age, race, gender, ethnicity, geographic knowledge, industry experience and expertise, board tenure and culture.

The Board and the Corporate Governance/Nominating Committee both assess the diversity policy to be effective insofar as it has been actively incorporated into discussions of the Corporate Governance/Nominating Committee with respect to Board membership occurring since the policy was adopted.

24

Other Governance Matters

The Board of Trustees is committed to strong corporate governance. Our governance framework is designed to promote the long-term interests of Washington REIT and our shareholders and strengthen Board and management accountability.

CORPORATE GOVERNANCE HIGHLIGHTS | ||

WHAT WE DO | ||

ü | Annual Election of Trustees. All of our Trustees stand for election annually | |

ü | Majority Voting Standard for Trustees with Trustee Resignation Policy. Our bylaws include a majority voting standard for the election of Trustees in uncontested elections. Under our Corporate Governance Guidelines, any incumbent Trustee who fails to receive the required vote for re-election is expected to offer to resign from our Board of Trustees. | |

ü | Concurrent Shareholder Power to Amend our Bylaws. Our bylaws may be amended by either shareholders or the Board. | |

ü | Independent Board. Six of our seven Trustees are independent and all members serving on our Audit, Compensation and Corporate Governance/Nominating Committees are independent. | |

ü | Lead Independent Trustee. Our Lead Independent Trustee ensures strong, independent leadership and oversight of our Board of Trustees by, among other things, presiding at executive sessions of the independent Trustees. | |

ü | Board Evaluations. Our Corporate Governance/Nominating Committee oversees annual evaluations of our Board and its committees. | |

ü | Risk Oversight by Full Board and Committees. A principal function of our Board is to oversee risk assessment and risk management related to our business. | |

ü | Code of Ethics. A robust Code of Business Ethics and Conduct is in place for our Trustees, officers and employees. | |

ü | Clawback Policy. Our Board has voluntarily adopted a formal clawback policy that applies to cash and equity incentive compensation. | |

ü | Anti-Hedging and Anti-Pledging. Our Trustees, officers and employees are subject to anti-hedging and anti-pledging policies. | |

ü | Annual Say-on-Pay. We annually submit “say-on-pay” advisory votes to shareholder for their consideration and vote. | |

ü | Sustainability. We strive to conduct our business in a socially responsible manner that balances consideration of environmental and social issues with creating long-term value for our Company and our shareholders. We publish an annual report on the achievement of our sustainability goals. | |

ü | No Over-boarding. Our Corporate Governance Guidelines limit Trustee membership on other public company boards. | |

ü | Shareholder-requested Meetings. Our bylaws permit shareholders to request the calling of a special meeting. | |

ü | No Poison Pill. No Shareholder Rights Plan in effect. | |

ü | Share Ownership Policy. We maintain a share ownership policy applicable to our trustees and senior officers. | |

Related Party Transactions Policy

When a reportable related party transaction arises, Washington REIT requires the review and approval of the Audit Committee. The Audit Committee will approve the transaction only if the Audit Committee believes that the transaction is in the best interests of Washington REIT.

25

Communications with the Board

The Board provides a process for shareholders and other interested parties to send communications to the entire Board or to any of the trustees. Shareholders and interested parties may send these written communications c/o Corporate Secretary, Washington Real Estate Investment Trust, 1775 Eye Street, N.W., Suite 1000, Washington, D.C. 20006. All communications will be compiled by the Corporate Secretary and submitted to the Board or the Lead Independent Trustee on a periodic basis.

Corporate Governance Guidelines

Washington REIT has adopted Corporate Governance Guidelines. Our Corporate Governance Guidelines, as well as the Committee Charters, are available on our website, www.washreit.com, under the heading “Investors” and subheading “Corporate Governance - Governance Documents,” and upon written request.

Code of Business Ethics and Conduct

Washington REIT has adopted a Code of Business Ethics and Conduct that applies to all of its trustees, officers and employees. The Code of Business Ethics and Conduct is available on our website, www.washreit.com, under the heading “Investors” and subheading “Corporate Governance - Governance Documents,” and available upon written request. Washington REIT intends to post on our website any amendments to, or waivers from, the Code of Business Ethics and Conduct promptly following the date of such amendment or waiver.

2019 Trustee Compensation

General

For 2019, our non-employee trustees (other than our Lead Independent Trustee) received an annual retainer of $35,000 plus an additional $1,500 per committee meeting attended. Our Lead Independent Trustee received an annual retainer of $110,000, with no additional compensation for committee meetings attended. Our Chairman does not sit on any of our committees but routinely attends committee meetings in the course of exercising his duties as Chairman. Our Committee Chairs also received additional retainers as follows: Audit Committee, $15,000; Corporate Governance/Nominating Committee, $11,000; and Compensation Committee, $11,000. Audit Committee members were also paid an additional annual retainer of $3,750.

26

Each of our non-employee trustees also receives an annual $100,000 common share grant, awarded 50% on December 15 of each calendar year and the remaining 50% on the earlier of the annual shareholders meeting date or May 15. The number of common shares is determined by the closing price of the common shares on the date of grant.

Washington REIT has adopted a non-qualified deferred compensation plan for non-employee trustees which was amended and restated effective October 21, 2015. The plan allows any non-employee trustee to defer a percentage or dollar amount of his or her cash compensation and/or all of his or her share compensation. Cash compensation deferred is credited with interest equivalent to the weighted average interest rate on Washington REIT’s fixed-rate bonds as of December 31 of each respective calendar year. A non-employee trustee may alternatively elect to designate that all of his or her annual board retainer and/or all of his or her share compensation be converted into restricted share units (“RSUs”) at the market price of common shares as of the end of the applicable quarter. The RSUs are credited with an amount equal to the corresponding dividends paid on Washington REIT’s common shares. Following a trustee’s separation from service, the deferred compensation plus earnings can be paid in either a lump sum or, in the case of deferred cash compensation only, in installments pursuant to a prior election of the trustee. Compensation deferred into RSUs is paid in the form of shares. Upon a trustee’s death, the trustee’s beneficiary will receive a lump sum payout of any RSUs in the form of shares, and any deferred cash compensation will be paid in accordance with the trustee’s prior election either as a lump sum or in installments. The plan is unfunded and payments are to be made from general assets of Washington REIT.

2020 Trustee Compensation

Following static trustee compensation in 2016, 2017, 2018 and 2019, the Compensation Committee in 2019, with assistance from FPL Associates L.P. (“FPL”), undertook an extensive review of trustee compensation and noted that, in general, trustee compensation ranked below the market median of our peers. As a result of the 2019 review, on February 14, 2020, the Board adopted new trustee compensation arrangements for non-employee trustees, which will take effect immediately following the Annual Meeting. The following is a summary of the updated trustee compensation arrangements:

• | Each non-employee trustee will receive an annual retainer of $55,000 in cash and $100,000 in common shares. The equity grant is awarded 50% on December 15 of each calendar year and the remaining 50% on the earlier of the annual shareholders meeting date or May 15 of the following calendar year. |

27

• | Each non-employee trustee who serves as a chair of one of the standing committees of the Board of Trustees, and each non-chair member of a standing committee, will receive an additional retainer as follows: |

Committee Chair | Annual Cash Chair Retainer |

Audit Committee | $20,000 |

Compensation Committee | $15,000 |

Corporate Governance/Nominating Committee | $14,000 |

Non-Chair Committee Member | Annual Cash Committee Retainer |

Audit Committee | $10,000 |

Compensation Committee | $7,500 |

Corporate Governance/Nominating Committee | $7,500 |

• | The Lead Independent Trustee will receive an additional annual retainer of $50,000 in cash. |

• | No additional fee will be paid based on Board or committee meeting attendance. |

In lieu of receiving their annual retainer in cash, a non-employee trustee may elect to receive the annual retainer in the form of fully vested RSUs.

Trustee Ownership Policy

The Board has adopted a trustee share ownership policy for non-employee trustees. Under the policy, each trustee is required to retain an aggregate number of common shares the value of which must equal at least five times the annual cash retainer.

In order to calculate the required number of shares, the annual cash retainer at the time of a trustee’s election (or, if later, the policy implementation date of July 23, 2014) is multiplied by five, with the resulting product then being divided by the average closing price for the 60 days prior to the date of election (or, if later, the policy implementation date). Each non-employee trustee is required to meet the threshold within five years after their initial election to the Board. Trustees whose initial election was more than five years before the policy implementation date were required to have met their ownership goal on the policy implementation date (and Washington REIT believes all such trustees did, in fact, meet their ownership goal on the policy implementation date).

28

In order to effectuate the foregoing policy, common shares received by trustees as compensation vest immediately but are restricted in transfer so long as the trustee serves on the Board pursuant to an additional Board-adopted policy. As a result of the foregoing, our Board members may only sell their common shares received as compensation for Board service after the conclusion of their service on the Board. We believe this transfer restriction strongly promotes the alignment of our Board members’ interests with the interests of our shareholders.

Trustee Compensation Table

The following table summarizes the compensation paid by Washington REIT to our non-employee trustees who served on the Board for the fiscal year ended December 31, 2019. All share awards are fully vested (but subject to the transfer restriction noted above). See “Principal and Management Shareholders - Trustee and Executive Officer Ownership” on page 31 for information on each Trustee’s beneficial ownership of shares. Mr. McDermott does not receive any compensation for his service as a member of the Board.

(a) | (b) | (c) | (f) | (h) | ||||||||

Name | Fees Earned or Paid in Cash (1) ($) | Stock Awards (2) ($) | Change in Pension Value and Deferred Compensation Earnings (3) ($) | Total ($) | ||||||||

Benjamin S. Butcher | $ | 48,500 | $ | 99,972 | $ | 73 | $ | 148,545 | ||||

William G. Byrnes | 50,750 | 99,972 | — | 150,722 | ||||||||

Edward S. Civera | 87,813 | 99,972 | — | 187,785 | ||||||||

Ellen M. Goitia | 59,000 | 99,972 | — | 158,972 | ||||||||

Charles T. Nason | 45,833 | 49,977 | 16,397 | 112,207 | ||||||||

Thomas H. Nolan, Jr. | 61,750 | 99,972 | — | 161,722 | ||||||||

Vice Adm. Anthony L. Winns (RET.) | 59,500 | 99,972 | — | 159,472 | ||||||||

(1) | The following trustees elected to receive their respective annual retainer fees in the form of fully vested shares, which election resulted in the following number of fully vested shares being granted during fiscal year 2019: Mr. Butcher, 1,255, and Mr. Byrnes, 1.255, which number of shares were determined using the closing price of the Company’s common shares on the NYSE on the applicable grant date. |

(2) Column (c) represents the total grant date fair value of all equity awards computed in accordance with FASB ASC Topic 718.

(3) Represents above market earnings on deferred compensation pursuant to the deferred compensation plan

Executive Officers

In 2019, Washington REIT had four named executive officers (“NEOs”), Messrs. McDermott, Bakke and Riffee and Ms. Fielder. Washington REIT has no executive officers other than our NEOs. On February 14, 2019, Mr. Bakke delivered a

29

notification to our Chairman, President and Chief Executive Officer of his decision to retire from Washington REIT effective March 8, 2019. The following table contains information regarding our NEOs for 2019.

NAMED EXECUTIVE OFFICER | AGE | POSITION |

Paul T. McDermott | 58 | Chairman, President and Chief Executive Officer |

Thomas Q. Bakke (1) | 65 | Executive Vice President and Chief Operating Officer |

Stephen E. Riffee | 62 | Executive Vice President and Chief Financial Officer |

Taryn D. Fielder | 42 | Senior Vice President, General Counsel and Corporate Secretary |

(1) Mr. Bakke retired effective March 8, 2019.

Biographical information for Mr. McDermott, who is both an executive officer and a trustee, can be found on page 14. There are no family relationships between any trustee and/or executive officer. There are no reportable related-party transactions.

Current Executive Officers

Stephen E. Riffee | |

Executive Vice President and Chief Financial Officer | |

| Stephen E. Riffee joined Washington REIT as Executive Vice President and Chief Financial Officer-elect on February 17, 2015. Mr. Riffee then was elected Chief Financial Officer on March 4, 2015. Prior to joining Washington REIT, Mr. Riffee served as Executive Vice President and Chief Financial Officer for Corporate Office Properties Trust ("COPT"), an NYSE office REIT, from 2006 to February 2015. In this role he oversaw all financial functions, including accounting, legal department and information technology at COPT. Between 2002 and 2006, her served as Executive Vice President and Chief ________ |

Financial Officer for CarrAmerica Realty Corporation, a NYSE-listed office REIT. | |

Taryn D. Fielder | |

Senior Vice President, General Counsel and Corporate Secretary | |

| Taryn D. Fielder joined Washington REIT as Senior Vice President, General Counsel and Corporate Secretary in March 2017. Prior to joining Washington REIT, Ms. Fielder served as Senior Vice President and General Counsel of ASB Real Estate Investments (“ASB”), a division of ASB Capital Management, LLC, a U.S. real estate investment management firm, from June 2013 until March 2017. As Senior Vice President and General Counsel, Ms. Fielder served as the principal legal advisor to ASB’s management team. Prior to joining ASB, Ms. Fielder served as Assistant General Counsel of DiamondRock Hospitality |

Company, an NYSE-listed REIT, from February 2011 until June 2013. Ms. Fielder was an associate in the Real Estate Group at Hogan & Hartson (now Hogan Lovells) from 2004 until 2011. Prior to joining Hogan & Hartson, Ms. Fielder spent two years with Simpson, Thacher and Bartlett LLP, from 2002 until 2004. | |

30

PRINCIPAL AND MANAGEMENT SHAREHOLDERS

Trustee and Executive Officer Ownership

The following table sets forth certain information concerning all common shares beneficially owned as of March 17, 2020 by each trustee, by each of the NEOs and by all current trustees and executive officers as a group. Unless otherwise indicated, the voting and investment powers for the common shares listed are held solely by the named holder and/or the holder’s spouse.

NAME | COMMON SHARES OWNED (3) | PERCENTAGE OF TOTAL | |

Thomas Q. Bakke (1) | 92,519 | * | |

Benjamin S. Butcher | 27,932 | * | |

William G. Byrnes | 72,356 | * | |

Edward S. Civera | 54,672 | * | |

Taryn D. Fielder | 38,566 | * | |

Ellen M. Goitia | 9,230 | * | |

Paul T. McDermott | 351,802 | * | |

Thomas H. Nolan, Jr. | 18,988 | * | |

Stephen E. Riffee | 99,481 | * | |

Vice Adm. Anthony L. Winns (RET.) | 29,052 | * | |

All Current Trustees and Executive Officers as a group (9 persons) (2) | 702,079 | * | |

(1) | Mr. Bakke retired effective March 8, 2019. The shares reflected in the table are as of his Section 16 exit filing. |

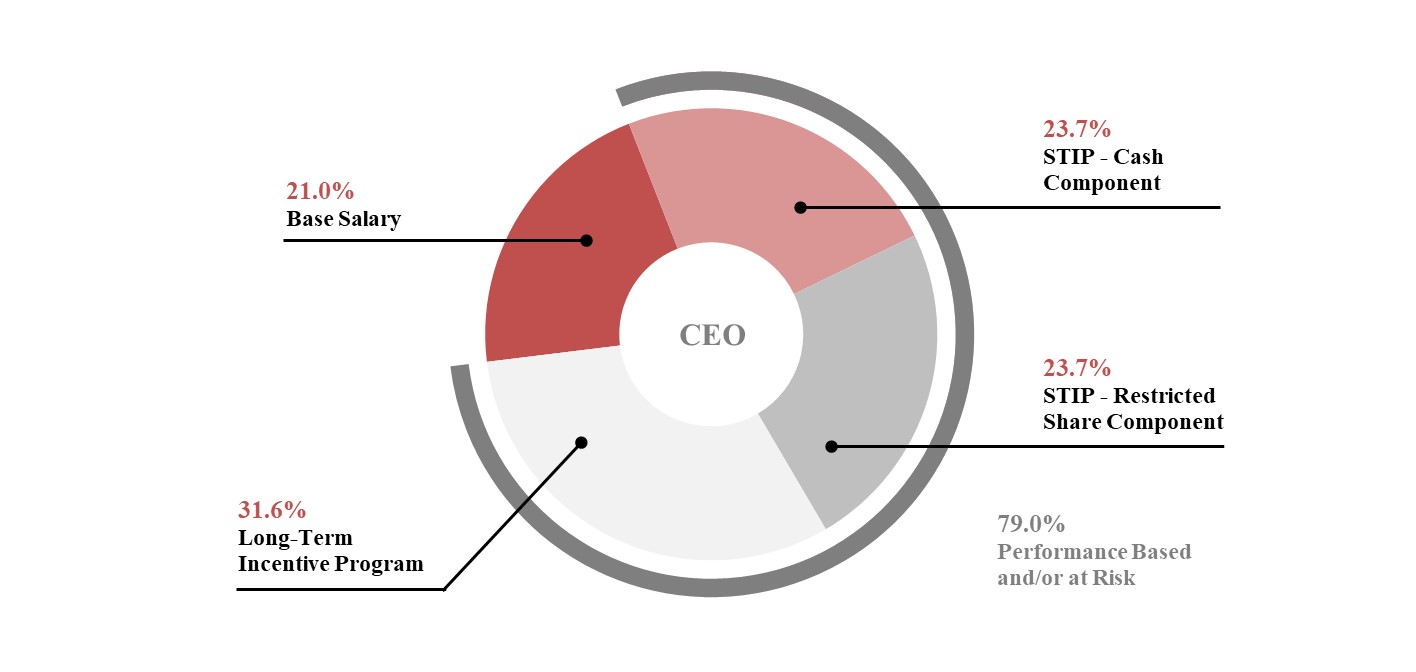

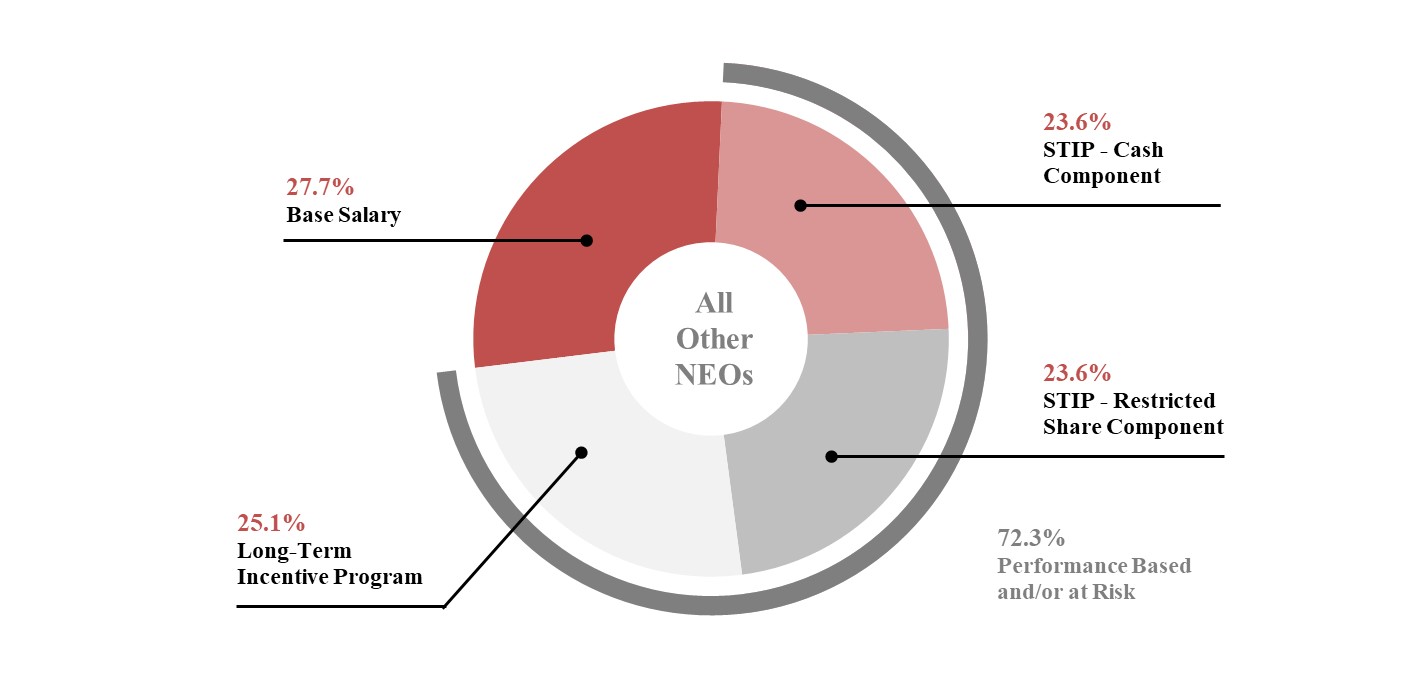

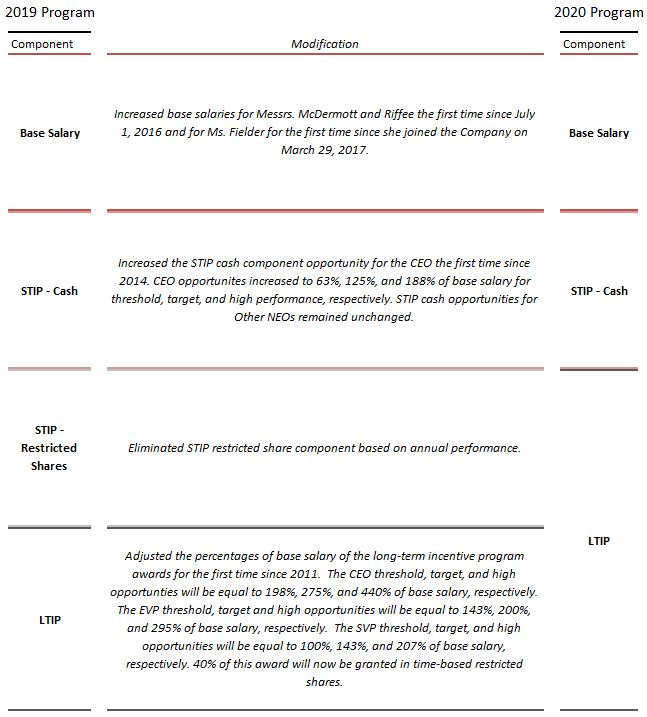

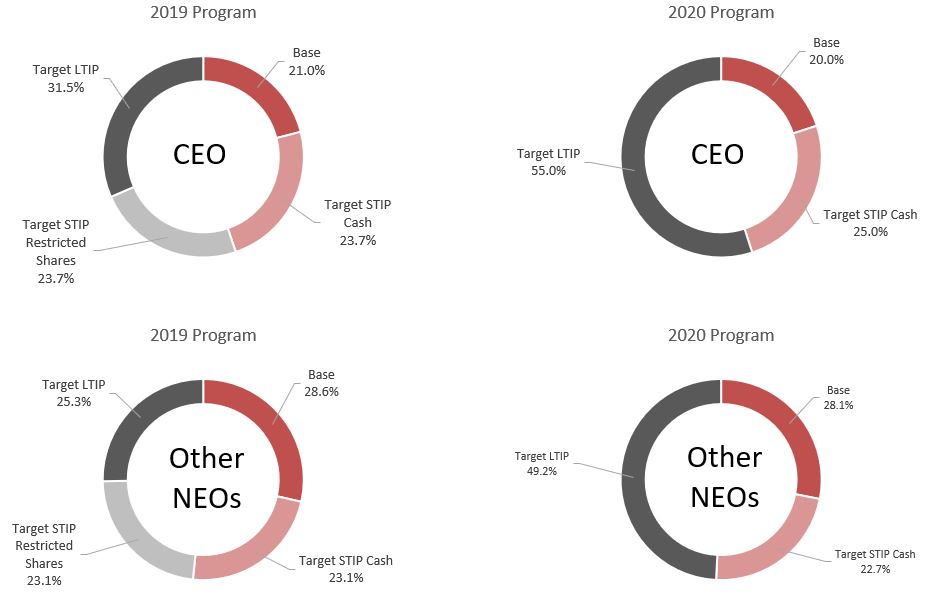

(2) | As a former executive officer, Mr. Bakke is not included in this group. |