| CONTACT: | 7550 Wisconsin Ave, Suite 900 | |||||||

| Amy Hopkins | Bethesda, MD 20814 | |||||||

| Vice President, Investor Relations | Tel 202-774-3198 | |||||||

| E-Mail: ahopkins@elmecommunities.com | Fax 301-984-9610 | |||||||

| www.elmecommunities.com | ||||||||

| October 26, 2023 | ||||||||

| Elme Communities Announces Third Quarter 2023 Results | ||||||||

| Full Year 2023 | Prior | Current | ||||||

| Core FFO per diluted share | $0.96 - $1.00 | $0.97 - $0.99 | ||||||

| Net Operating Income Assumptions | ||||||||

| Same-store multifamily NOI growth | 8.0% - 9.0% | 8.0% - 9.0% | ||||||

Non-same-store multifamily NOI (a) | $12.0 million - $12.75 million | $13.0 million - $13.75 million | ||||||

Non-residential NOI (b) | ~$0.8 million | ~$0.8 million | ||||||

Other same-store NOI (c) | $12.5 million - $13.25 million | $12.75 million - $13.25 million | ||||||

| Expense Assumptions | ||||||||

| Property management expense | $8.0 million - $8.5 million | $8.0 million - $8.25 million | ||||||

| G&A, net of core adjustments | $24.5 million - $25.5 million | $24.75 million - $25.25 million | ||||||

| Interest expense | $28.0 million - $28.75 million | $30.25 million - $30.75 million | ||||||

(a) Includes Elme Sandy Springs, Elme Cumberland, Elme Marietta, Elme Druid Hills and Riverside Development. Guidance does not contemplate any additional acquisitions or dispositions. | ||||||||

(b) Includes revenues and expenses from retail operations at multifamily communities | ||||||||

(c) Consists of Watergate 600 | ||||||||

| Low | High | |||||||

Net loss per diluted share | $(0.15) | $(0.13) | ||||||

| Real estate depreciation and amortization | 1.03 | 1.03 | ||||||

| NAREIT FFO per diluted share | 0.88 | 0.90 | ||||||

| Core adjustments | 0.09 | 0.09 | ||||||

| Core FFO per diluted share | $0.97 | $0.99 | ||||||

| ELME COMMUNITIES AND SUBSIDIARIES | |||||||||||||||||||||||

| FINANCIAL HIGHLIGHTS | |||||||||||||||||||||||

| (In thousands, except per share data) | |||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| OPERATING RESULTS | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Revenue | |||||||||||||||||||||||

| Real estate rental revenue | $ | 56,651 | $ | 54,603 | $ | 169,059 | $ | 153,787 | |||||||||||||||

| Expenses | |||||||||||||||||||||||

| Property operating and maintenance | 12,747 | 13,092 | 38,510 | 35,404 | |||||||||||||||||||

| Real estate taxes and insurance | 7,050 | 6,469 | 21,066 | 19,893 | |||||||||||||||||||

| Property management | 1,935 | 1,916 | 5,882 | 5,462 | |||||||||||||||||||

| General and administrative | 6,370 | 6,403 | 19,891 | 20,998 | |||||||||||||||||||

| Transformation costs | 985 | 2,399 | 6,339 | 6,645 | |||||||||||||||||||

| Depreciation and amortization | 21,904 | 23,632 | 64,855 | 69,871 | |||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | |||||||||||||||||||

| 92,851 | 53,911 | 198,403 | 158,273 | ||||||||||||||||||||

| Real estate operating income (loss) | (36,200) | 692 | (29,344) | (4,486) | |||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||

| Interest expense | (7,418) | (6,582) | (21,043) | (18,388) | |||||||||||||||||||

| Loss on extinguishment of debt | — | (4,917) | (54) | (4,917) | |||||||||||||||||||

| Other income | — | 68 | 569 | 454 | |||||||||||||||||||

| (7,418) | (11,431) | (20,528) | (22,851) | ||||||||||||||||||||

| Net loss | $ | (43,618) | $ | (10,739) | $ | (49,872) | $ | (27,337) | |||||||||||||||

| Net loss | $ | (43,618) | $ | (10,739) | $ | (49,872) | $ | (27,337) | |||||||||||||||

| Depreciation and amortization | 21,904 | 23,632 | 64,855 | 69,871 | |||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | |||||||||||||||||||

| NAREIT funds from operations | $ | 20,146 | $ | 12,893 | $ | 56,843 | $ | 42,534 | |||||||||||||||

| Non-cash loss on extinguishment of debt | $ | — | $ | 4,873 | $ | 54 | $ | 4,873 | |||||||||||||||

| Tenant improvements and incentives, net of reimbursements | — | — | (10) | (1,025) | |||||||||||||||||||

| Leasing commissions capitalized | — | — | (56) | — | |||||||||||||||||||

| Recurring capital improvements | (1,490) | (2,404) | (5,950) | (5,026) | |||||||||||||||||||

| Straight-line rents, net | (74) | (112) | (160) | (437) | |||||||||||||||||||

| Non-cash fair value interest expense | — | 105 | — | 210 | |||||||||||||||||||

| Non-real estate depreciation & amortization of debt costs | 1,348 | 1,158 | 3,891 | 3,517 | |||||||||||||||||||

| Amortization of lease intangibles, net | (155) | (227) | (570) | (608) | |||||||||||||||||||

| Amortization and expensing of restricted share and unit compensation | 1,432 | 1,917 | 3,966 | 6,157 | |||||||||||||||||||

| Adjusted funds from operations | $ | 21,207 | $ | 18,203 | $ | 58,008 | $ | 50,195 | |||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| Per share data: | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Net loss | (Basic) | $ | (0.50) | $ | (0.12) | $ | (0.57) | $ | (0.32) | |||||||||||||||||

| (Diluted) | $ | (0.50) | $ | (0.12) | $ | (0.57) | $ | (0.32) | ||||||||||||||||||

| NAREIT FFO | (Basic) | $ | 0.23 | $ | 0.15 | $ | 0.65 | $ | 0.48 | |||||||||||||||||

| (Diluted) | $ | 0.23 | $ | 0.15 | $ | 0.64 | $ | 0.48 | ||||||||||||||||||

| Dividends paid | $ | 0.18 | $ | 0.17 | $ | 0.54 | $ | 0.51 | ||||||||||||||||||

| Weighted average shares outstanding - basic | 87,759 | 87,453 | 87,717 | 87,354 | ||||||||||||||||||||||

| Weighted average shares outstanding - diluted | 87,759 | 87,453 | 87,717 | 87,354 | ||||||||||||||||||||||

| Weighted average shares outstanding - diluted (for NAREIT FFO) | 87,799 | 87,564 | 87,809 | 87,447 | ||||||||||||||||||||||

| ELME COMMUNITIES AND SUBSIDIARIES | |||||||||||

| CONSOLIDATED BALANCE SHEETS | |||||||||||

| (In thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| September 30, 2023 | December 31, 2022 | ||||||||||

| Assets | |||||||||||

| Land | $ | 384,097 | $ | 373,171 | |||||||

| Income producing property | 1,941,663 | 1,897,835 | |||||||||

| 2,325,760 | 2,271,006 | ||||||||||

| Accumulated depreciation and amortization | (506,298) | (481,588) | |||||||||

| Net income producing property | 1,819,462 | 1,789,418 | |||||||||

| Properties under development or held for future development | 31,095 | 31,260 | |||||||||

| Total real estate held for investment, net | 1,850,557 | 1,820,678 | |||||||||

| Cash and cash equivalents | 8,079 | 8,389 | |||||||||

| Restricted cash | 2,104 | 1,463 | |||||||||

| Rents and other receivables | 15,300 | 16,346 | |||||||||

| Prepaid expenses and other assets | 34,233 | 25,730 | |||||||||

| Total assets | $ | 1,910,273 | $ | 1,872,606 | |||||||

| Liabilities | |||||||||||

| Notes payable, net | $ | 522,150 | $ | 497,359 | |||||||

| Line of credit | 149,000 | 55,000 | |||||||||

| Accounts payable and other liabilities | 40,666 | 34,386 | |||||||||

| Dividend payable | 15,868 | 14,934 | |||||||||

| Advance rents | 3,365 | 1,578 | |||||||||

| Tenant security deposits | 6,171 | 5,563 | |||||||||

| Total liabilities | 737,220 | 608,820 | |||||||||

| Equity | |||||||||||

| Shareholders' equity | |||||||||||

| Preferred shares; $0.01 par value; 10,000 shares authorized; no shares issued or outstanding | — | — | |||||||||

Shares of beneficial interest, $0.01 par value; 150,000 shares authorized: 87,832 and 87,534 shares issued and outstanding, as of September 30, 2023 and December 31, 2022, respectively | 878 | 875 | |||||||||

| Additional paid in capital | 1,734,657 | 1,729,854 | |||||||||

| Distributions in excess of net income | (550,442) | (453,008) | |||||||||

| Accumulated other comprehensive loss | (12,332) | (14,233) | |||||||||

| Total shareholders' equity | 1,172,761 | 1,263,488 | |||||||||

| Noncontrolling interests in subsidiaries | 292 | 298 | |||||||||

| Total equity | 1,173,053 | 1,263,786 | |||||||||

| Total liabilities and equity | $ | 1,910,273 | $ | 1,872,606 | |||||||

| The following tables contain reconciliations of net loss to NOI and same-store NOI for the periods presented (in thousands): | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net loss | $ | (43,618) | $ | (10,739) | $ | (49,872) | $ | (27,337) | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Property management expense | 1,935 | 1,916 | 5,882 | 5,462 | |||||||||||||||||||

| General and administrative expense | 6,370 | 6,403 | 19,891 | 20,998 | |||||||||||||||||||

| Transformation costs | 985 | 2,399 | 6,339 | 6,645 | |||||||||||||||||||

| Real estate depreciation and amortization | 21,904 | 23,632 | 64,855 | 69,871 | |||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | |||||||||||||||||||

| Interest expense | 7,418 | 6,582 | 21,043 | 18,388 | |||||||||||||||||||

| Loss on extinguishment of debt, net | — | 4,917 | 54 | 4,917 | |||||||||||||||||||

| Other income | — | (68) | (569) | (454) | |||||||||||||||||||

| Total Net Operating Income (NOI) | $ | 36,854 | $ | 35,042 | $ | 109,483 | $ | 98,490 | |||||||||||||||

| Multifamily NOI: | |||||||||||||||||||||||

| Same-store Portfolio | $ | 30,336 | $ | 28,264 | $ | 89,903 | $ | 82,012 | |||||||||||||||

| Acquisitions | 3,165 | 3,291 | 9,172 | 5,924 | |||||||||||||||||||

| Development | (56) | (52) | (168) | (71) | |||||||||||||||||||

| Non-residential | 189 | 188 | 620 | 593 | |||||||||||||||||||

| Total | 33,634 | 31,691 | 99,527 | 88,458 | |||||||||||||||||||

| Other NOI (Watergate 600) | 3,220 | 3,351 | 9,956 | 10,032 | |||||||||||||||||||

| Total NOI | $ | 36,854 | $ | 35,042 | $ | 109,483 | $ | 98,490 | |||||||||||||||

| The following table contains a reconciliation of net loss to core funds from operations for the periods presented (in thousands, except per share data): | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||

| Net loss | $ | (43,618) | $ | (10,739) | $ | (49,872) | $ | (27,337) | ||||||||||||||||||

| Add: | ||||||||||||||||||||||||||

| Real estate depreciation and amortization | 21,904 | 23,632 | 64,855 | 69,871 | ||||||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | ||||||||||||||||||||||

| NAREIT funds from operations | 20,146 | 12,893 | 56,843 | 42,534 | ||||||||||||||||||||||

| Add: | ||||||||||||||||||||||||||

| Structuring expenses | — | 121 | 60 | 1,101 | ||||||||||||||||||||||

| Loss on extinguishment of debt, net | — | 4,917 | 54 | 4,917 | ||||||||||||||||||||||

| Severance expense | — | — | 394 | 474 | ||||||||||||||||||||||

| Transformation costs | 985 | 2,399 | 6,339 | 6,645 | ||||||||||||||||||||||

| Write-off of pursuit costs | — | 174 | 49 | 174 | ||||||||||||||||||||||

| Relocation expense | 306 | — | 626 | — | ||||||||||||||||||||||

| Core funds from operations | $ | 21,437 | $ | 20,504 | $ | 64,365 | $ | 55,845 | ||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| Per share data: | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| NAREIT FFO | (Basic) | $ | 0.23 | $ | 0.15 | $ | 0.65 | $ | 0.48 | |||||||||||||||||

| (Diluted) | $ | 0.23 | $ | 0.15 | $ | 0.64 | $ | 0.48 | ||||||||||||||||||

| Core FFO | (Basic) | $ | 0.24 | $ | 0.23 | $ | 0.73 | $ | 0.64 | |||||||||||||||||

| (Diluted) | $ | 0.24 | $ | 0.23 | $ | 0.73 | $ | 0.64 | ||||||||||||||||||

| Weighted average shares outstanding - basic | 87,759 | 87,453 | 87,717 | 87,354 | ||||||||||||||||||||||

| Weighted average shares outstanding - diluted (for NAREIT and Core FFO) | 87,799 | 87,564 | 87,809 | 87,447 | ||||||||||||||||||||||

| Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (in thousands): | |||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net loss | $ | (43,618) | $ | (10,739) | $ | (49,872) | $ | (27,337) | |||||||||||||||

| Add/(deduct): | |||||||||||||||||||||||

| Interest expense | 7,418 | 6,582 | 21,043 | 18,388 | |||||||||||||||||||

| Real estate depreciation and amortization | 21,904 | 23,632 | 64,855 | 69,871 | |||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | |||||||||||||||||||

| Non-real estate depreciation | 291 | 189 | 728 | 644 | |||||||||||||||||||

| Severance expense | — | — | 394 | 474 | |||||||||||||||||||

| Transformation costs | 985 | 2,399 | 6,339 | 6,645 | |||||||||||||||||||

| Relocation expense | 306 | — | 626 | — | |||||||||||||||||||

| Structuring expenses | — | 121 | 60 | 1,101 | |||||||||||||||||||

| Loss on extinguishment of debt | — | 4,917 | 54 | 4,917 | |||||||||||||||||||

| Adjusted EBITDA | $ | 29,146 | $ | 27,101 | $ | 86,087 | $ | 74,703 | |||||||||||||||

| Non-GAAP Financial Measures | ||||||||||||||

| Other Definitions | ||||||||||||||

| Table of Contents |  | ||||

September 30, 2023 | |||||

| Schedule | Page | |||||||

| Key Financial Data | ||||||||

| Portfolio Analysis | ||||||||

Net Operating Income (NOI) - Multifamily | ||||||||

Same-Store Operating Results - Multifamily | ||||||||

Same-Store Operating Expenses - Multifamily | ||||||||

| Growth and Strategy | ||||||||

| Acquisition Summary | ||||||||

| Schedule of Communities | ||||||||

| Capital Analysis | ||||||||

| Reconciliations | ||||||||

Consolidated Statements of Operations (In thousands, except per share data) (Unaudited) |  | ||||

| Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||||||||||||||||

| OPERATING RESULTS | September 30, 2023 | September 30, 2022 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | ||||||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||||||||

| Real estate rental revenue | $ | 169,059 | $ | 153,787 | $ | 56,651 | $ | 56,599 | $ | 55,809 | $ | 55,593 | $ | 54,603 | |||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||||||||

| Property operating and maintenance | (38,510) | (35,404) | (12,747) | (13,364) | (12,399) | (12,126) | (13,092) | ||||||||||||||||||||||||||||||||||

| Real estate taxes and insurance | (21,066) | (19,893) | (7,050) | (6,894) | (7,122) | (6,578) | (6,469) | ||||||||||||||||||||||||||||||||||

| Property management | (5,882) | (5,462) | (1,935) | (2,178) | (1,769) | (1,974) | (1,916) | ||||||||||||||||||||||||||||||||||

| General and administrative | (19,891) | (20,998) | (6,370) | (6,680) | (6,841) | (7,260) | (6,403) | ||||||||||||||||||||||||||||||||||

| Transformation costs | (6,339) | (6,645) | (985) | (2,454) | (2,900) | (3,041) | (2,399) | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | (64,855) | (69,871) | (21,904) | (21,415) | (21,536) | (21,851) | (23,632) | ||||||||||||||||||||||||||||||||||

| Real estate impairment | (41,860) | — | (41,860) | — | — | — | — | ||||||||||||||||||||||||||||||||||

| (198,403) | (158,273) | (92,851) | (52,985) | (52,567) | (52,830) | (53,911) | |||||||||||||||||||||||||||||||||||

| Real estate operating (loss) income | (29,344) | (4,486) | (36,200) | 3,614 | 3,242 | 2,763 | 692 | ||||||||||||||||||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||||||||||||||||||||

| Interest expense | (21,043) | (18,388) | (7,418) | (6,794) | (6,831) | (6,552) | (6,582) | ||||||||||||||||||||||||||||||||||

| Loss on extinguishment of debt | (54) | (4,917) | — | — | (54) | — | (4,917) | ||||||||||||||||||||||||||||||||||

| Other income | 569 | 454 | — | 569 | — | 258 | 68 | ||||||||||||||||||||||||||||||||||

| Net loss | $ | (49,872) | $ | (27,337) | $ | (43,618) | $ | (2,611) | $ | (3,643) | $ | (3,531) | $ | (10,739) | |||||||||||||||||||||||||||

| Per Share Data: | |||||||||||||||||||||||||||||||||||||||||

| Net loss | $ | (0.57) | $ | (0.32) | $ | (0.50) | $ | (0.03) | $ | (0.04) | $ | (0.04) | $ | (0.12) | |||||||||||||||||||||||||||

| Fully diluted weighted average shares outstanding | 87,717 | 87,354 | 87,759 | 87,741 | 87,649 | 87,491 | 87,453 | ||||||||||||||||||||||||||||||||||

| Percentage of Revenues: | |||||||||||||||||||||||||||||||||||||||||

| General and administrative expenses | 11.8 | % | 13.7 | % | 11.2 | % | 11.8 | % | 12.3 | % | 13.1 | % | 11.7 | % | |||||||||||||||||||||||||||

| Net loss | (29.5) | % | (17.8) | % | (77.0) | % | (4.6) | % | (6.5) | % | (6.4) | % | (19.7) | % | |||||||||||||||||||||||||||

| Ratios: | |||||||||||||||||||||||||||||||||||||||||

Adjusted EBITDA(1) / Interest expense | 4.1 | x | 4.1 | x | 3.9 | x | 4.2 | x | 4.2 | x | 4.3 | x | 4.1 | x | |||||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||||||||||||||

Consolidated Balance Sheets (In thousands, except per share data) (Unaudited) |  | ||||

| September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Land | $ | 384,097 | $ | 373,113 | $ | 373,171 | $ | 373,171 | $ | 373,171 | |||||||||||||||||||

| Income producing property | 1,941,663 | 1,911,381 | 1,903,648 | 1,897,835 | 1,882,235 | ||||||||||||||||||||||||

| 2,325,760 | 2,284,494 | 2,276,819 | 2,271,006 | 2,255,406 | |||||||||||||||||||||||||

| Accumulated depreciation and amortization | (506,298) | (523,153) | (502,104) | (481,588) | (461,293) | ||||||||||||||||||||||||

| Net income producing property | 1,819,462 | 1,761,341 | 1,774,715 | 1,789,418 | 1,794,113 | ||||||||||||||||||||||||

| Properties under development or held for future development | 31,095 | 31,260 | 31,260 | 31,260 | 31,232 | ||||||||||||||||||||||||

| Total real estate held for investment, net | 1,850,557 | 1,792,601 | 1,805,975 | 1,820,678 | 1,825,345 | ||||||||||||||||||||||||

| Cash and cash equivalents | 8,079 | 5,554 | 7,044 | 8,389 | 8,436 | ||||||||||||||||||||||||

| Restricted cash | 2,104 | 1,887 | 1,487 | 1,463 | 1,437 | ||||||||||||||||||||||||

| Rents and other receivables | 15,300 | 15,746 | 16,095 | 16,346 | 16,088 | ||||||||||||||||||||||||

| Prepaid expenses and other assets | 34,233 | 22,711 | 24,398 | 25,730 | 28,228 | ||||||||||||||||||||||||

| Total assets | $ | 1,910,273 | $ | 1,838,499 | $ | 1,854,999 | $ | 1,872,606 | $ | 1,879,534 | |||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Notes payable, net | $ | 522,150 | $ | 521,955 | $ | 521,761 | $ | 497,359 | $ | 497,247 | |||||||||||||||||||

| Line of credit | 149,000 | 24,000 | 35,000 | 55,000 | 43,000 | ||||||||||||||||||||||||

| Accounts payable and other liabilities | 40,666 | 36,920 | 28,583 | 34,386 | 36,219 | ||||||||||||||||||||||||

| Dividend payable | 15,868 | 15,834 | 15,869 | 14,934 | 14,919 | ||||||||||||||||||||||||

| Advance rents | 3,365 | 2,949 | 1,800 | 1,578 | 1,489 | ||||||||||||||||||||||||

| Tenant security deposits | 6,171 | 5,913 | 5,671 | 5,563 | 5,461 | ||||||||||||||||||||||||

| Total liabilities | 737,220 | 607,571 | 608,684 | 608,820 | 598,335 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| Preferred shares; $0.01 par value; 10,000 shares authorized | — | — | — | — | — | ||||||||||||||||||||||||

| Shares of beneficial interest, $0.01 par value; 150,000 shares authorized | 878 | 878 | 877 | 875 | 875 | ||||||||||||||||||||||||

| Additional paid-in capital | 1,734,657 | 1,733,388 | 1,731,701 | 1,729,854 | 1,728,840 | ||||||||||||||||||||||||

| Distributions in excess of net income | (550,442) | (490,939) | (472,503) | (453,008) | (434,539) | ||||||||||||||||||||||||

| Accumulated other comprehensive loss | (12,332) | (12,693) | (14,056) | (14,233) | (14,278) | ||||||||||||||||||||||||

| Total shareholders' equity | 1,172,761 | 1,230,634 | 1,246,019 | 1,263,488 | 1,280,898 | ||||||||||||||||||||||||

| Noncontrolling interests in subsidiaries | 292 | 294 | 296 | 298 | 301 | ||||||||||||||||||||||||

| Total equity | 1,173,053 | 1,230,928 | 1,246,315 | 1,263,786 | 1,281,199 | ||||||||||||||||||||||||

| Total liabilities and equity | $ | 1,910,273 | $ | 1,838,499 | $ | 1,854,999 | $ | 1,872,606 | $ | 1,879,534 | |||||||||||||||||||

NAREIT Funds from Operations/ Adjusted Funds From Operations (In thousands, except per share data) (Unaudited) |  | ||||

| Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||

| Funds from operations (FFO) | |||||||||||||||||||||||||||||||||||||||||

| Net loss | $ | (49,872) | $ | (27,337) | $ | (43,618) | $ | (2,611) | $ | (3,643) | $ | (3,531) | $ | (10,739) | |||||||||||||||||||||||||||

| Real estate depreciation and amortization | 64,855 | 69,871 | 21,904 | 21,415 | 21,536 | 21,851 | 23,632 | ||||||||||||||||||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | — | — | — | ||||||||||||||||||||||||||||||||||

NAREIT funds from operations (FFO)(1) | 56,843 | 42,534 | 20,146 | 18,804 | 17,893 | 18,320 | 12,893 | ||||||||||||||||||||||||||||||||||

| Loss on extinguishment of debt | 54 | 4,917 | — | — | 54 | — | 4,917 | ||||||||||||||||||||||||||||||||||

| Severance expense | 394 | 474 | — | — | 394 | — | — | ||||||||||||||||||||||||||||||||||

| Transformation costs | 6,339 | 6,645 | 985 | 2,454 | 2,900 | 3,041 | 2,399 | ||||||||||||||||||||||||||||||||||

| Relocation expense | 626 | — | 306 | 134 | 186 | 74 | — | ||||||||||||||||||||||||||||||||||

| Structuring expenses | 60 | 1,101 | — | — | 60 | 60 | 121 | ||||||||||||||||||||||||||||||||||

| Write-off of pursuit costs | 49 | 174 | — | 9 | 40 | — | 174 | ||||||||||||||||||||||||||||||||||

Core FFO(1) | $ | 64,365 | $ | 55,845 | $ | 21,437 | $ | 21,401 | $ | 21,527 | $ | 21,495 | $ | 20,504 | |||||||||||||||||||||||||||

Allocation to participating securities(2) | (209) | (191) | (71) | (68) | (70) | (41) | (68) | ||||||||||||||||||||||||||||||||||

| NAREIT FFO per share - basic | $ | 0.65 | $ | 0.48 | $ | 0.23 | $ | 0.21 | $ | 0.20 | $ | 0.21 | $ | 0.15 | |||||||||||||||||||||||||||

| NAREIT FFO per share - fully diluted | $ | 0.64 | $ | 0.48 | $ | 0.23 | $ | 0.21 | $ | 0.20 | $ | 0.21 | $ | 0.15 | |||||||||||||||||||||||||||

| Core FFO per share - fully diluted | $ | 0.73 | $ | 0.64 | $ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.24 | $ | 0.23 | |||||||||||||||||||||||||||

| Common dividend per share | $ | 0.54 | $ | 0.51 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.17 | $ | 0.17 | |||||||||||||||||||||||||||

| Average shares - basic | 87,717 | 87,354 | 87,759 | 87,741 | 87,649 | 87,491 | 87,453 | ||||||||||||||||||||||||||||||||||

| Average shares - fully diluted (for NAREIT FFO and Core FFO) | 87,809 | 87,447 | 87,799 | 87,785 | 87,840 | 87,622 | 87,564 | ||||||||||||||||||||||||||||||||||

NAREIT Funds from Operations/ Adjusted Funds From Operations (continued) (In thousands, except per share data) (Unaudited) |  | ||||

| Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||

Adjusted funds from operations (AFFO) (1) | |||||||||||||||||||||||||||||||||||||||||

NAREIT FFO(1) | $ | 56,843 | $ | 42,534 | $ | 20,146 | $ | 18,804 | $ | 17,893 | $ | 18,320 | $ | 12,893 | |||||||||||||||||||||||||||

| Non-cash loss on extinguishment of debt | 54 | 4,873 | — | — | 54 | — | 4,873 | ||||||||||||||||||||||||||||||||||

| Tenant improvements and incentives, net of reimbursements | (10) | (1,025) | — | — | (10) | — | — | ||||||||||||||||||||||||||||||||||

| Leasing commissions capitalized | (56) | — | — | — | (56) | (16) | — | ||||||||||||||||||||||||||||||||||

| Recurring capital improvements | (5,950) | (5,026) | (1,490) | (2,456) | (2,004) | (2,656) | (2,404) | ||||||||||||||||||||||||||||||||||

| Straight-line rent, net | (160) | (437) | (74) | (57) | (29) | (55) | (112) | ||||||||||||||||||||||||||||||||||

| Non-cash fair value interest expense | — | 210 | — | — | — | — | 105 | ||||||||||||||||||||||||||||||||||

| Non-real estate depreciation and amortization of debt costs | 3,891 | 3,517 | 1,348 | 1,276 | 1,267 | 1,147 | 1,158 | ||||||||||||||||||||||||||||||||||

| Amortization of lease intangibles, net | (570) | (608) | (155) | (178) | (237) | (337) | (227) | ||||||||||||||||||||||||||||||||||

Amortization and expensing of restricted share and unit compensation(3) | 3,966 | 6,157 | 1,432 | 1,346 | 1,188 | 1,831 | 1,917 | ||||||||||||||||||||||||||||||||||

AFFO(1) | 58,008 | 50,195 | 21,207 | 18,735 | 18,066 | 18,234 | 18,203 | ||||||||||||||||||||||||||||||||||

| Cash loss on extinguishment of debt | — | 44 | — | — | — | — | 44 | ||||||||||||||||||||||||||||||||||

| Non-share-based severance expense | 340 | 202 | — | 340 | — | — | |||||||||||||||||||||||||||||||||||

| Relocation expense | 626 | — | 306 | 134 | 186 | 74 | — | ||||||||||||||||||||||||||||||||||

| Structuring expenses | 60 | 1,101 | — | — | 60 | 60 | 121 | ||||||||||||||||||||||||||||||||||

Transformation costs(4) | 6,339 | 6,337 | 985 | 2,454 | 2,900 | 3,041 | 2,399 | ||||||||||||||||||||||||||||||||||

| Write-off of pursuit costs | 49 | 174 | — | 9 | 40 | — | 174 | ||||||||||||||||||||||||||||||||||

Core AFFO(1) | $ | 65,422 | $ | 58,053 | $ | 22,498 | $ | 21,332 | $ | 21,592 | $ | 21,409 | $ | 20,941 | |||||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||||||||||||||

(1) See "Definitions" on page 12 for the definitions of non-GAAP measures: NAREIT FFO, Core FFO, AFFO, and Core AFFO. | |||||||||||||||||||||||||||||||||||||||||

(2) Adjustment to the numerators for FFO and Core FFO per share calculations when applying the two-class method for calculating EPS. | |||||||||||||||||||||||||||||||||||||||||

(3) Includes share award modifications related to transformation costs. | |||||||||||||||||||||||||||||||||||||||||

(4) Excludes share award modifications related to transformation costs. | |||||||||||||||||||||||||||||||||||||||||

Net Operating Income (NOI) - Multifamily (Dollars In thousands) |  | ||||

| Apartment Homes as of 9/30/2023 | Nine Months Ended | Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||||||||

| Rental and other property revenues | |||||||||||||||||||||||||||||||||||||||||||||||

| Same-store | 7,790 | $ | 139,182 | $ | 129,440 | $ | 46,610 | $ | 46,786 | $ | 45,786 | $ | 45,051 | $ | 44,735 | ||||||||||||||||||||||||||||||||

| Acquisitions | 1,579 | 15,269 | 9,622 | 5,233 | 5,079 | 4,957 | 5,314 | 4,897 | |||||||||||||||||||||||||||||||||||||||

| Development | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Non-residential(1) | N/A | 705 | 807 | 222 | 235 | 248 | 266 | 257 | |||||||||||||||||||||||||||||||||||||||

Total rental and other property revenues(2) | 9,369 | 155,156 | 139,869 | 52,065 | 52,100 | 50,991 | 50,631 | 49,889 | |||||||||||||||||||||||||||||||||||||||

| Property operating expenses | |||||||||||||||||||||||||||||||||||||||||||||||

| Same-store | 49,279 | 47,428 | 16,274 | 16,765 | 16,240 | 15,390 | 16,471 | ||||||||||||||||||||||||||||||||||||||||

| Acquisitions | 6,097 | 3,698 | 2,068 | 2,203 | 1,826 | 1,810 | 1,606 | ||||||||||||||||||||||||||||||||||||||||

| Development | 168 | 71 | 56 | 54 | 58 | 57 | 52 | ||||||||||||||||||||||||||||||||||||||||

| Non-residential | 85 | 214 | 33 | 32 | 20 | 67 | 69 | ||||||||||||||||||||||||||||||||||||||||

| Total property operating expenses | 55,629 | 51,411 | 18,431 | 19,054 | 18,144 | 17,324 | 18,198 | ||||||||||||||||||||||||||||||||||||||||

Net Operating Income (NOI)(3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Same-store | 89,903 | 82,012 | 30,336 | 30,021 | 29,546 | 29,661 | 28,264 | ||||||||||||||||||||||||||||||||||||||||

| Acquisitions | 9,172 | 5,924 | 3,165 | 2,876 | 3,131 | 3,504 | 3,291 | ||||||||||||||||||||||||||||||||||||||||

| Development | (168) | (71) | (56) | (54) | (58) | (57) | (52) | ||||||||||||||||||||||||||||||||||||||||

| Non-residential | 620 | 593 | 189 | 203 | 228 | 199 | 188 | ||||||||||||||||||||||||||||||||||||||||

| Total NOI | $ | 99,527 | $ | 88,458 | $ | 33,634 | $ | 33,046 | $ | 32,847 | $ | 33,307 | $ | 31,691 | |||||||||||||||||||||||||||||||||

| Same-store metrics | |||||||||||||||||||||||||||||||||||||||||||||||

Operating margin(4) | 65% | 63% | 65% | 64% | 65% | 66% | 63% | ||||||||||||||||||||||||||||||||||||||||

| Retention | 63% | 63% | 61% | 63% | 64% | 60% | 60% | ||||||||||||||||||||||||||||||||||||||||

| Same-store effective lease rate growth | |||||||||||||||||||||||||||||||||||||||||||||||

| New | 0.3% | 11.3% | 0.1% | 0.4% | 0.7% | 1.5% | 11.2% | ||||||||||||||||||||||||||||||||||||||||

| Renewal | 6.2% | 11.3% | 5.1% | 6.4% | 8.0% | 10.5% | 11.6% | ||||||||||||||||||||||||||||||||||||||||

| Blended | 3.6% | 11.3% | 3.0% | 3.7% | 4.5% | 5.9% | 11.4% | ||||||||||||||||||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||||||||||||||||||||

(1) Includes revenues and expenses from retail operations at multifamily properties. | |||||||||||||||||||||||||||||||||||||||||||||||

(2) Utility costs reimbursed by residents are included in real estate rental revenue on our consolidated statements of operations. Utility reimbursements totaled $6.1 million and $5.4 million for the nine months ended September 30, 2023 and 2022 respectively, and $1.9 million, $2.2 million, $2.1 million,$1.9 million and $1.9 million for the three months ended September 30, 2023, June 30, 2023, March 31, 2023, December 31, 2022 and September 30, 2022, respectively. | |||||||||||||||||||||||||||||||||||||||||||||||

(4) Operating margin is calculated by dividing the same-store NOI (non-GAAP) by same-store rental and other property revenues. | |||||||||||||||||||||||||||||||||||||||||||||||

Same-Store Operating Results - Multifamily (Dollars in thousands, except Average Effective Monthly Rent per Home) |  | ||||

| Rental and Other Property Revenue | Property Operating Expenses | Net Operating Income (1) | Average Occupancy | Average Effective Monthly Rent per Home | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarter-to-Date Comparison | Apt Homes | Q3 2023 | Q3 2022 | % Chg | Q3 2023 | Q3 2022 | % Chg | Q3 2023 | Q3 2022 | % Chg | Q3 2023 | Q3 2022 | % Chg | Q3 2023 | Q3 2022 | % Chg | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virginia | 5,545 | $ | 34,507 | $ | 33,165 | 4.0 | % | $ | 11,599 | $ | 11,730 | (1.1) | % | $ | 22,908 | $ | 21,435 | 6.9 | % | 95.9 | % | 95.3 | % | 0.6 | % | $ | 1,963 | $ | 1,879 | 4.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DC / Maryland | 1,515 | 8,987 | 8,317 | 8.1 | % | 3,092 | 3,191 | (3.1) | % | 5,895 | 5,126 | 15.0 | % | 96.5 | % | 96.5 | % | — | % | 1,935 | 1,801 | 7.4 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 730 | 3,116 | 3,253 | (4.2) | % | $ | 1,583 | $ | 1,550 | 2.1 | % | 1,533 | 1,703 | (10.0) | % | 92.0 | % | 94.2 | % | (2.2) | % | 1,451 | 1,410 | 2.9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 7,790 | $ | 46,610 | $ | 44,735 | 4.2 | % | $ | 16,274 | $ | 16,471 | (1.2) | % | $ | 30,336 | $ | 28,264 | 7.3 | % | 95.6 | % | 95.4 | % | 0.2 | % | $ | 1,910 | $ | 1,820 | 4.9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sequential Comparison | Apt Homes | Q3 2023 | Q2 2023 | % Chg | Q3 2023 | Q2 2023 | % Chg | Q3 2023 | Q2 2023 | % Chg | Q3 2023 | Q2 2023 | % Chg | Q3 2023 | Q2 2023 | % Chg | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virginia | 5,545 | $ | 34,507 | $ | 34,687 | (0.5) | % | $ | 11,599 | $ | 12,074 | (3.9) | % | $ | 22,908 | $ | 22,613 | 1.3 | % | 95.9 | % | 95.8 | % | 0.1 | % | $ | 1,963 | $ | 1,942 | 1.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DC / Maryland | 1,515 | 8,987 | 8,741 | 2.8 | % | 3,092 | 3,268 | (5.4) | % | 5,895 | 5,473 | 7.7 | % | 96.5 | % | 95.8 | % | 0.7 | % | 1,935 | 1,900 | 1.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 730 | 3,116 | 3,358 | (7.2) | % | $ | 1,583 | $ | 1,423 | 11.2 | % | 1,533 | 1,935 | (20.8) | % | 92.0 | % | 93.9 | % | (1.9) | % | 1,451 | 1,474 | (1.6) | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 7,790 | $ | 46,610 | $ | 46,786 | (0.4) | % | $ | 16,274 | $ | 16,765 | (2.9) | % | $ | 30,336 | $ | 30,021 | 1.0 | % | 95.6 | % | 95.6 | % | — | % | $ | 1,910 | $ | 1,890 | 1.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-Date Comparison | Apt Homes | YTD 2023 | YTD 2022 | % Chg | YTD 2023 | YTD 2022 | % Chg | YTD 2023 | YTD 2022 | % Chg | YTD 2023 | YTD 2022 | % Chg | YTD 2023 | YTD 2022 | % Chg | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Virginia | 5,545 | $ | 102,953 | $ | 95,886 | 7.4 | % | $ | 35,197 | $ | 33,966 | 3.6 | % | $ | 67,756 | $ | 61,920 | 9.4 | % | 95.7 | % | 95.5 | % | 0.2 | % | $ | 1,941 | $ | 1,812 | 7.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DC / Maryland | 1,515 | 26,391 | 24,458 | 7.9 | % | 9,537 | 9,112 | 4.7 | % | 16,854 | 15,346 | 9.8 | % | 96.0 | % | 96.3 | % | (0.3) | % | 1,901 | 1,759 | 8.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 730 | 9,838 | 9,096 | 8.2 | % | $ | 4,545 | $ | 4,350 | 4.5 | % | 5,293 | 4,746 | 11.5 | % | 93.6 | % | 94.6 | % | (1.0) | % | $ | 1,463 | $ | 1,335 | 9.6 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 7,790 | $ | 139,182 | $ | 129,440 | 7.5 | % | $ | 49,279 | $ | 47,428 | 3.9 | % | $ | 89,903 | $ | 82,012 | 9.6 | % | 95.6 | % | 95.6 | % | — | % | $ | 1,889 | $ | 1,757 | 7.5 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

______________________________ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Same-Store Operating Expenses - Multifamily (In thousands) |  | ||||

| Quarter-to-Date Comparison | Q3 2023 | Q3 2022 | $ Change | % Change | % of Q3 2023 Total | ||||||||||||||||||||||||

Controllable operating expenses(1) | $ | 7,998 | $ | 8,678 | $ | (680) | (7.8) | % | 49.2 | % | |||||||||||||||||||

| Real estate taxes | 4,824 | 4,678 | 146 | 3.1 | % | 29.6 | % | ||||||||||||||||||||||

| Utilities | 2,619 | 2,389 | 230 | 9.6 | % | 16.1 | % | ||||||||||||||||||||||

| Insurance | 833 | 726 | 107 | 14.7 | % | 5.1 | % | ||||||||||||||||||||||

| Total same-store operating expenses | 16,274 | 16,471 | (197) | (1.2) | % | 100.0 | % | ||||||||||||||||||||||

| Utility reimbursements | (1,520) | (1,630) | 110 | (6.7) | % | ||||||||||||||||||||||||

| Total same-store operating expenses, net of utility reimbursements | $ | 14,754 | $ | 14,841 | $ | (87) | (0.6) | % | |||||||||||||||||||||

| Sequential Comparison | Q3 2023 | Q2 2023 | $ Change | % Change | % of Q3 2023 Total | ||||||||||||||||||||||||

| Controllable operating expenses | $ | 7,998 | $ | 8,937 | $ | (939) | (10.5) | % | 49.2 | % | |||||||||||||||||||

| Real estate taxes | 4,824 | 4,750 | 74 | 1.6 | % | 29.6 | % | ||||||||||||||||||||||

| Utilities | 2,619 | 2,337 | 282 | 12.1 | % | 16.1 | % | ||||||||||||||||||||||

| Insurance | 833 | 741 | 92 | 12.4 | % | 5.1 | % | ||||||||||||||||||||||

| Total same-store operating expenses | 16,274 | 16,765 | (491) | (2.9) | % | 100.0 | % | ||||||||||||||||||||||

| Utility reimbursements | (1,520) | (1,923) | 403 | (21.0) | % | ||||||||||||||||||||||||

| Total same-store operating expenses, net of utility reimbursements | $ | 14,754 | $ | 14,842 | $ | (88) | (0.6) | % | |||||||||||||||||||||

| Year-to-Date Comparison | YTD 2023 | YTD 2022 | $ Change | % Change | % of YTD 2023 Total | ||||||||||||||||||||||||

| Controllable operating expenses | $ | 24,562 | $ | 23,990 | $ | 572 | 2.4 | % | 49.8 | % | |||||||||||||||||||

| Real estate taxes | 14,575 | 14,384 | 191 | 1.3 | % | 29.6 | % | ||||||||||||||||||||||

| Utilities | 7,843 | 6,895 | 948 | 13.7 | % | 15.9 | % | ||||||||||||||||||||||

| Insurance | 2,299 | 2,159 | 140 | 6.5 | % | 4.7 | % | ||||||||||||||||||||||

| Total same-store operating expenses | 49,279 | 47,428 | 1,851 | 3.9 | % | 100.0 | % | ||||||||||||||||||||||

| Utility reimbursements | (5,264) | (4,977) | (287) | 5.8 | % | ||||||||||||||||||||||||

| Total same-store operating expenses, net of utility reimbursements | $ | 44,015 | $ | 42,451 | $ | 1,564 | 3.7 | % | |||||||||||||||||||||

______________________________ | ||

(1) Controllable operating expenses consist of: | ||

| Payroll, Repairs & Maintenance, Marketing, Administrative and other | ||

Acquisition Summary (Dollars in thousands) |  | ||||

| Acquisitions | |||||||||||||||||||||||||||||

| Location | Acquisition Date | Number of Homes | Ending Occupancy (as of September 30, 2023) | Contract Purchase Price | |||||||||||||||||||||||||

| Elme Druid Hills | Atlanta, GA | September 29, 2023 | 500 | 93.4% | $ | 108,000 | |||||||||||||||||||||||

| Multifamily Communities |  | ||||

| September 30, 2023 | |||||

| Community | Location | Apartment Homes | Current Strategy | Year Acquired | Year Built | Average Occupancy(1) | Ending Occupancy | % of Total Portfolio NOI(1,2) | |||||||||||||||||||||

| Virginia | |||||||||||||||||||||||||||||

| Elme Alexandria | Alexandria, VA | 532 | B Value-Add | 2019 | 1990 | 94.5% | 95.3% | 5% | |||||||||||||||||||||

| Cascade at Landmark | Alexandria, VA | 277 | B Value-Add | 2019 | 1988 | 95.6% | 98.2% | 3% | |||||||||||||||||||||

| Clayborne | Alexandria, VA | 74 | A- | N/A | 2008 | 96.3% | 95.9% | 1% | |||||||||||||||||||||

| Riverside Apartments | Alexandria, VA | 1,222 | B Value-Add | 2016 | 1971 | 96.0% | 96.1% | 12% | |||||||||||||||||||||

| Bennett Park | Arlington, VA | 224 | A- | N/A | 2007 | 95.4% | 97.8% | 4% | |||||||||||||||||||||

| Park Adams | Arlington, VA | 200 | B | 1969 | 1959 | 96.6% | 95.5% | 2% | |||||||||||||||||||||

| The Maxwell | Arlington, VA | 163 | A- | N/A | 2014 | 97.2% | 95.1% | 2% | |||||||||||||||||||||

| The Paramount | Arlington, VA | 135 | B | 2013 | 1984 | 96.4% | 97.0% | 2% | |||||||||||||||||||||

| The Wellington | Arlington, VA | 710 | B Value-Add | 2015 | 1960 | 95.9% | 97.5% | 7% | |||||||||||||||||||||

| Trove | Arlington, VA | 401 | A | N/A | 2020 | 96.0% | 96.0% | 5% | |||||||||||||||||||||

| Roosevelt Towers | Falls Church, VA | 191 | B | 1965 | 1964 | 96.0% | 95.3% | 2% | |||||||||||||||||||||

| Elme Dulles | Herndon, VA | 328 | B Value-Add | 2019 | 2000 | 95.6% | 97.0% | 4% | |||||||||||||||||||||

| Elme Herndon | Herndon, VA | 283 | B Value-Add | 2019 | 1991 | 96.0% | 97.5% | 3% | |||||||||||||||||||||

| Elme Leesburg | Leesburg, VA | 134 | B | 2019 | 1986 | 95.3% | 97.0% | 1% | |||||||||||||||||||||

| Elme Manassas | Manassas, VA | 408 | B Value-Add | 2019 | 1986 | 94.7% | 93.9% | 4% | |||||||||||||||||||||

| The Ashby at McLean | McLean, VA | 263 | B | 1996 | 1982 | 95.9% | 96.6% | 4% | |||||||||||||||||||||

| Washington, DC | |||||||||||||||||||||||||||||

| 3801 Connecticut Avenue | Washington, DC | 307 | B Value-Add | 1963 | 1951 | 96.7% | 95.8% | 3% | |||||||||||||||||||||

| Kenmore Apartments | Washington, DC | 371 | B Value-Add | 2008 | 1948 | 95.9% | 96.0% | 3% | |||||||||||||||||||||

| Yale West | Washington, DC | 216 | A- | 2014 | 2011 | 95.5% | 95.8% | 3% | |||||||||||||||||||||

| Maryland | |||||||||||||||||||||||||||||

| Elme Bethesda | Bethesda, MD | 193 | B | 1997 | 1986 | 96.5% | 97.4% | 3% | |||||||||||||||||||||

| Elme Watkins Mill | Gaithersburg, MD | 210 | B | 2019 | 1975 | 95.4% | 96.2% | 2% | |||||||||||||||||||||

| Elme Germantown | Germantown, MD | 218 | B Value-Add | 2019 | 1990 | 96.0% | 97.2% | 2% | |||||||||||||||||||||

| Georgia | |||||||||||||||||||||||||||||

| Elme Conyers | Conyers, GA | 240 | B | 2021 | 1999 | 94.0% | 91.3% | 2% | |||||||||||||||||||||

| Elme Eagles Landing | Stockbridge, GA | 490 | B | 2021 | 2000 | 93.4% | 89.4% | 3% | |||||||||||||||||||||

| Total same-store communities | 7,790 | 95.6% | 95.7% | 82% | |||||||||||||||||||||||||

| Multifamily Communities (continued) |  | ||||

| September 30, 2023 | |||||

| Community | Location | Apartment Homes | Current Strategy | Year Acquired | Year Built | Average Occupancy(1,3) | Ending Occupancy (3) | % of Total Portfolio NOI(1,2) | |||||||||||||||||||||

Georgia | |||||||||||||||||||||||||||||

| Elme Marietta | Marietta, GA | 420 | B Value-Add | 2022 | 1975 | 93.5% | 91.9% | 4% | |||||||||||||||||||||

| Elme Sandy Springs | Sandy Springs, GA | 389 | B Value-Add | 2022 | 1972 | 94.0% | 92.3% | 3% | |||||||||||||||||||||

| Elme Cumberland | Smyrna, GA | 270 | B Value-Add | 2022 | 1982 | 94.1% | 91.5% | 2% | |||||||||||||||||||||

| Elme Druid Hills | Atlanta, GA | 500 | B Value-Add | 2023 | 1987 | 93.5% | 93.4% | —% | |||||||||||||||||||||

| Total non same-store communities | 1,579 | 93.8% | 92.4% | 9% | |||||||||||||||||||||||||

| Total multifamily communities | 9,369 | 95.4% | 95.2% | 91% | |||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||

(1) For the nine months ended September 30, 2023. | |||||||||||||||||||||||||||||

(3) Includes results at Elme Druid Hills for periods prior to the Company's ownership. Results for periods prior to the Company's ownership have not been included in the Company's Consolidated Financial Statements and are included only for comparison purposes. Results included for periods prior to the Company's ownership are based on information from the prior owner of the community and have not been audited or adjusted. | |||||||||||||||||||||||||||||

| Office Property |  | ||||

| September 30, 2023 | |||||

| Property | Location | Year Acquired | Year Built | Net Rentable Square Feet | Leased %(1) | Ending Occupancy(1) | % of Total Portfolio NOI(2,3) | |||||||||||||||||||||||||||||||||||||

| Washington, DC | ||||||||||||||||||||||||||||||||||||||||||||

| Watergate 600 | Washington, DC | 2017 | 1972/1997 | 300,000 | 87.8% | 87.8% | 9% | |||||||||||||||||||||||||||||||||||||

______________________________ | ||||||||||||||||||||||||||||||||||||||||||||

(1) The leased and occupied square footage includes short-term lease agreements. | ||||||||||||||||||||||||||||||||||||||||||||

(2) For the nine months ended September 30, 2023. | ||||||||||||||||||||||||||||||||||||||||||||

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (In thousands) (Unaudited) |  | ||||

| Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||

Adjusted EBITDA(1) | |||||||||||||||||||||||||||||||||||||||||

| Net loss | $ | (49,872) | $ | (27,337) | $ | (43,618) | $ | (2,611) | $ | (3,643) | $ | (3,531) | $ | (10,739) | |||||||||||||||||||||||||||

| Add/(deduct): | |||||||||||||||||||||||||||||||||||||||||

| Interest expense | 21,043 | 18,388 | 7,418 | 6,794 | 6,831 | 6,552 | 6,582 | ||||||||||||||||||||||||||||||||||

| Real estate depreciation and amortization | 64,855 | 69,871 | 21,904 | 21,415 | 21,536 | 21,851 | 23,632 | ||||||||||||||||||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Non-real estate depreciation | 728 | 644 | 291 | 222 | 215 | 178 | 189 | ||||||||||||||||||||||||||||||||||

| Severance expense | 394 | 474 | — | — | 394 | — | — | ||||||||||||||||||||||||||||||||||

| Transformation costs | 6,339 | 6,645 | 985 | 2,454 | 2,900 | 3,041 | 2,399 | ||||||||||||||||||||||||||||||||||

| Relocation expense | 626 | — | 306 | 134 | 186 | 74 | — | ||||||||||||||||||||||||||||||||||

| Structuring expenses | 60 | 1,101 | — | — | 60 | 60 | 121 | ||||||||||||||||||||||||||||||||||

| Loss on extinguishment of debt | 54 | 4,917 | — | — | 54 | — | 4,917 | ||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 86,087 | $ | 74,703 | $ | 29,146 | $ | 28,408 | $ | 28,533 | $ | 28,225 | $ | 27,101 | |||||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||||||||||||||

(1) Adjusted EBITDA is a non-GAAP measure. See "Definitions" on page 12 for the definition of Adjusted EBITDA and reconciliation of Net loss to Adjusted EBITDA on the current page. | |||||||||||||||||||||||||||||||||||||||||

Long Term Debt Analysis (Dollars in thousands) |  | ||||

| September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||

| Balances Outstanding | |||||||||||||||||||||||||||||

| Unsecured | |||||||||||||||||||||||||||||

| Fixed rate bonds | $ | 397,679 | $ | 397,590 | $ | 397,502 | $ | 397,413 | $ | 397,324 | |||||||||||||||||||

Term loan(1) | 124,471 | 124,365 | 124,259 | 99,946 | 99,923 | ||||||||||||||||||||||||

| Credit facility | 149,000 | 24,000 | 35,000 | 55,000 | 43,000 | ||||||||||||||||||||||||

| Total | $ | 671,150 | $ | 545,955 | $ | 556,761 | $ | 552,359 | $ | 540,247 | |||||||||||||||||||

| Weighted Average Interest Rates | |||||||||||||||||||||||||||||

| Unsecured | |||||||||||||||||||||||||||||

| Fixed rate bonds | 4.5 | % | 4.5 | % | 4.5 | % | 4.5 | % | 4.5 | % | |||||||||||||||||||

Term loan(2) | 4.7 | % | 3.0 | % | 3.0 | % | 2.3 | % | 2.3 | % | |||||||||||||||||||

| Credit facility | 6.3 | % | 6.0 | % | 5.7 | % | 5.2 | % | 4.0 | % | |||||||||||||||||||

| Weighted Average | 4.9 | % | 4.2 | % | 4.2 | % | 4.2 | % | 4.1 | % | |||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||

(1) Elme Communities entered into a $125.0 million unsecured term loan ("2023 Term Loan") with an interest rate of SOFR (subject to a credit spread adjustment of 10 basis points) plus a margin of 95 basis points (subject to adjustment depending on Elme Communities' credit rating). The 2023 Term Loan has a two-year term ending in January 2025, with two one-year extension options. We used the proceeds to prepay the $100.0 million 2018 Term Loan in full and a portion of our borrowings under our unsecured credit facility. | |||||||||||||||||||||||||||||

(2) Elme Communities had an interest rate swap that had effectively fixed the interest rate on a $100.0 million portion of its 2023 Term Loan outstanding through the interest rate swap arrangement's expiration date of July 21, 2023. In March 2023, we entered into two interest rate swap arrangements with an aggregate notional amount of $125.0 million that effectively fixed the interest at 4.73% for the 2023 Term Loan beginning on July 21, 2023 through the 2023 Term Loan’s maturity date of January 10, 2025 (see page 28). | |||||||||||||||||||||||||||||

Note: The current debt balances outstanding are shown net of discounts, premiums and unamortized debt costs (see page 29). | |||||||||||||||||||||||||||||

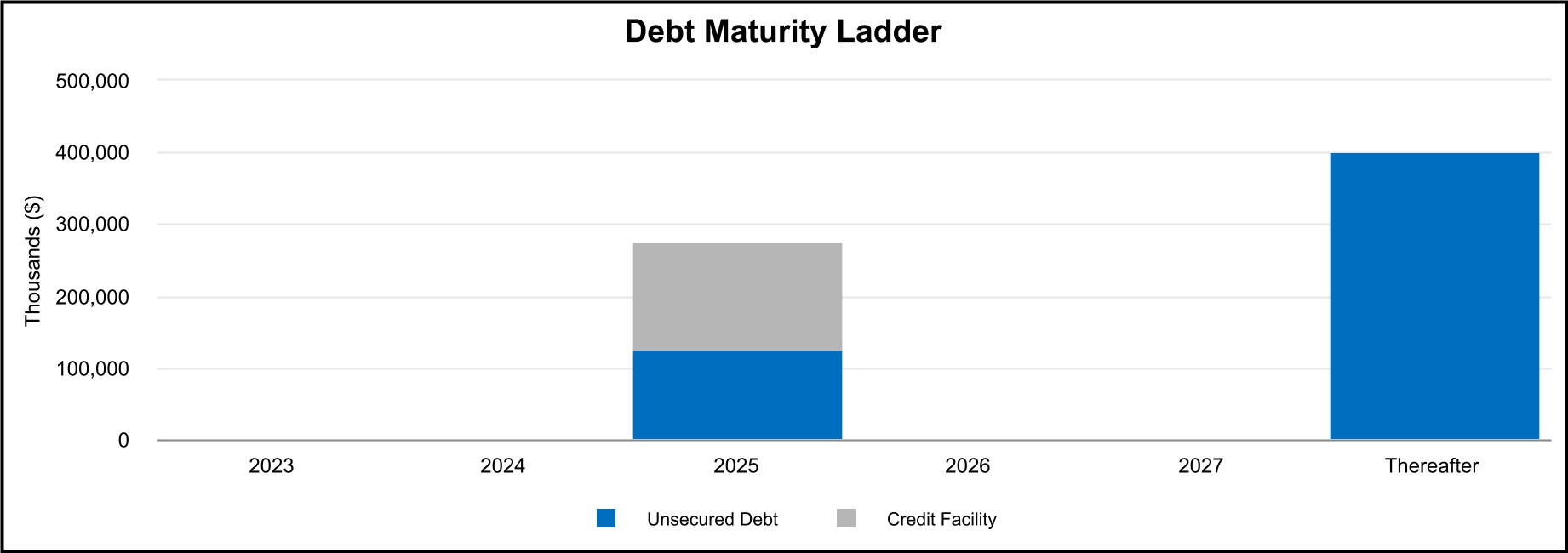

Long Term Debt Maturities (in thousands, except average interest rates) |  | ||||

| September 30, 2023 | |||||

| Future Maturities of Debt | |||||||||||||||||||||||

| Year | Unsecured Debt | Credit Facility | Total Debt | Avg Interest Rate | |||||||||||||||||||

| 2023 | $ | — | $ | — | $ | — | —% | ||||||||||||||||

| 2024 | — | — | — | —% | |||||||||||||||||||

| 2025 | 125,000 | (1) | 149,000 | (2) | 274,000 | 5.6% | |||||||||||||||||

| 2026 | — | — | — | —% | |||||||||||||||||||

| 2027 | — | — | — | —% | |||||||||||||||||||

| Thereafter | 400,000 | — | 400,000 | 4.5% | |||||||||||||||||||

| Scheduled principal payments | $ | 525,000 | $ | 149,000 | $ | 674,000 | 4.9% | ||||||||||||||||

| Net discounts/premiums | (99) | — | (99) | ||||||||||||||||||||

| Loan costs, net of amortization | (2,751) | — | (2,751) | ||||||||||||||||||||

| Total maturities | $ | 522,150 | $ | 149,000 | $ | 671,150 | 4.9% | ||||||||||||||||

Weighted average maturity = 4.8 years | |||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||

(1) Elme Communities previously entered into an interest rate swap to effectively fix a LIBOR plus 110 basis points floating interest rate to a 2.31% all-in fixed rate for the remaining $100.0 million portion of the 2018 Term Loan. The interest rate was fixed through the term loan maturity of July 21, 2023. During the first quarter of 2023, we entered into a $125.0 million unsecured term loan ("2023 Term Loan") with an interest rate of SOFR (subject to a credit spread adjustment of 10 basis points) plus a margin of 95 basis points. The 2023 Term Loan has a two-year term ending in January 2025, with two one-year extension options. We used the proceeds to prepay the $100.0 million 2018 Term Loan in full and a portion of our borrowings under our unsecured credit facility. Subsequent to this transaction, the interest rate swap effectively fixed a $100.0 million portion of the 2023 Term Loan at 2.16% through the interest rate swap's expiration date of July 21, 2023. In March 2023, we entered into two interest rate swap arrangements with an aggregate notional amount of $125.0 million that effectively fix the interest at 4.73% for the 2023 Term Loan beginning on July 21, 2023 through the 2023 Term Loan’s maturity date of January 10, 2025. | |||||||||||||||||||||||

(2) The credit facility's term ends in August 2025, with two six-month extension options. | |||||||||||||||||||||||

Debt Covenant Compliance |  | ||||

| Unsecured Public Debt Covenants | Unsecured Private Debt Covenants | ||||||||||||||||||||||||||||||||||

| Notes Payable | Line of Credit and Term Loans | Notes Payable | |||||||||||||||||||||||||||||||||

| Quarter Ended September 30, 2023 | Covenant | Quarter Ended September 30, 2023 | Covenant | Quarter Ended September 30, 2023 | Covenant | ||||||||||||||||||||||||||||||

% of Total Indebtedness to Total Assets(1) | 32.9 | % | ≤ 65.0% | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||

| Ratio of Income Available for Debt Service to Annual Debt Service | 3.7 | ≥ 1.5 | N/A | N/A | N/A | N/A | |||||||||||||||||||||||||||||

% of Secured Indebtedness to Total Assets(1) | — | % | ≤ 40.0% | N/A | N/A | N/A | N/A | ||||||||||||||||||||||||||||

Ratio of Total Unencumbered Assets(2) to Total Unsecured Indebtedness | 3.0 | ≥ 1.5 | N/A | N/A | N/A | N/A | |||||||||||||||||||||||||||||

% of Net Consolidated Total Indebtedness to Consolidated Total Asset Value(3) | N/A | N/A | 25.7 | % | ≤ 60.0% | 25.7 | % | ≤ 60.0% | |||||||||||||||||||||||||||

Ratio of Consolidated Adjusted EBITDA(4) to Consolidated Fixed Charges(5) | N/A | N/A | 4.49 | ≥ 1.50 | 4.49 | ≥ 1.50 | |||||||||||||||||||||||||||||

% of Consolidated Secured Indebtedness to Consolidated Total Asset Value(3) | N/A | N/A | — | % | ≤ 40.0% | — | % | ≤ 40.0% | |||||||||||||||||||||||||||

% of Consolidated Unsecured Indebtedness to Unencumbered Pool Value(6) | N/A | N/A | 25.7 | % | ≤ 60.0% | 25.7 | % | ≤ 60.0% | |||||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||||||||

(1) Total Assets is calculated by applying a capitalization rate of 7.50% to the EBITDA(4) from the last four consecutive quarters, excluding EBITDA from acquired, disposed, and non-stabilized development properties. | |||||||||||||||||||||||||||||||||||

(2) Total Unencumbered Assets is calculated by applying a capitalization rate of 7.50% to the EBITDA(4) from unencumbered properties from the last four consecutive quarters, excluding EBITDA from acquired, disposed, and non-stabilized development properties. | |||||||||||||||||||||||||||||||||||

(3) Consolidated Total Asset Value is the sum of unrestricted cash plus the quotient of applying a capitalization rate to the annualized NOI from the most recently ended quarter for each asset class, excluding NOI from disposed properties, acquisitions during the past 6 quarters, development, major redevelopment and low occupancy properties. To this amount, we add the purchase price of acquisitions during the past 6 quarters plus values for development, major redevelopment and low occupancy properties. | |||||||||||||||||||||||||||||||||||

(4) Consolidated Adjusted EBITDA is defined as earnings before noncontrolling interests, depreciation, amortization, interest expense, income tax expense, acquisition costs, extraordinary, unusual or nonrecurring transactions including sale of assets, impairment, gains and losses on extinguishment of debt and other non-cash charges. | |||||||||||||||||||||||||||||||||||

(5) Consolidated Fixed Charges consist of interest expense excluding capitalized interest and amortization of deferred financing costs, principal payments and preferred dividends, if any. | |||||||||||||||||||||||||||||||||||

(6) Unencumbered Pool Value is the sum of unrestricted cash plus the quotient of applying a capitalization rate to the annualized NOI from unencumbered properties from the most recently ended quarter for each asset class excluding NOI from disposed properties, acquisitions during the past 6 quarters, development, major redevelopment and low occupancy properties. To this we add the purchase price of unencumbered acquisitions during the past 6 quarters and values for unencumbered development, major redevelopment and low occupancy properties. | |||||||||||||||||||||||||||||||||||

Capital Analysis (In thousands, except per share amounts) |  | ||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||||

| Market Data | |||||||||||||||||||||||||||||||||||||||||

| Shares Outstanding | 87,832 | 87,809 | 87,709 | 87,534 | 87,504 | ||||||||||||||||||||||||||||||||||||

| Market Price per Share | $ | 13.64 | $ | 16.44 | $ | 17.86 | $ | 17.80 | $ | 17.56 | |||||||||||||||||||||||||||||||

| Equity Market Capitalization | $ | 1,198,028 | $ | 1,443,580 | $ | 1,566,483 | $ | 1,558,105 | $ | 1,536,570 | |||||||||||||||||||||||||||||||

| Total Debt | $ | 671,150 | $ | 545,955 | $ | 556,761 | $ | 552,359 | $ | 540,247 | |||||||||||||||||||||||||||||||

| Total Market Capitalization | $ | 1,869,178 | $ | 1,989,535 | $ | 2,123,244 | $ | 2,110,464 | $ | 2,076,817 | |||||||||||||||||||||||||||||||

| Total Debt to Market Capitalization | 0.36 | :1 | 0.27 | :1 | 0.26 | :1 | 0.26 | :1 | 0.26 | :1 | |||||||||||||||||||||||||||||||

Earnings to Fixed Charges(1) | -4.9x | 0.6x | 0.5x | 0.5x | -0.6x | ||||||||||||||||||||||||||||||||||||

Debt Service Coverage Ratio(2) | 3.9x | 4.2x | 4.2x | 4.3x | 4.1x | ||||||||||||||||||||||||||||||||||||

| Dividend Data | Nine Months Ended | Three Months Ended | |||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||

| Total Dividends Declared | $ | 47,562 | $ | 44,708 | $ | 15,885 | $ | 15,825 | $ | 15,852 | $ | 14,938 | $ | 14,918 | |||||||||||||||||||||||||||

| Common Dividend Declared per Share | $ | 0.54 | $ | 0.51 | $ | 0.18 | $ | 0.18 | $ | 0.18 | $ | 0.17 | $ | 0.17 | |||||||||||||||||||||||||||

Payout Ratio (Core FFO basis)(3) | 74.0 | % | 79.7 | % | 75.0 | % | 75.0 | % | 75.0 | % | 70.8 | % | 73.9 | % | |||||||||||||||||||||||||||

Payout Ratio (Core AFFO basis)(4) | 73.0 | % | 77.3 | % | 69.2 | % | 70.8 | % | |||||||||||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||||||||||||||

(1) The ratio of earnings to fixed charges is computed by dividing earnings by fixed charges. For this purpose, earnings consist of income from continuing operations attributable to the controlling interests plus fixed charges, less capitalized interest. Fixed charges consist of interest expense, including amortized costs of debt issuance, plus interest costs capitalized. The earnings to fixed charges ratio includes real estate impairment of $41.9 million for the three months ended September 30, 2023 and loss on extinguishment of debt of $4.9 million for the three months ended September 30, 2022. | |||||||||||||||||||||||||||||||||||||||||

(2) Debt service coverage ratio is calculated by dividing Adjusted EBITDA by interest expense and principal amortization. Adjusted EBITDA is a non-GAAP measure. See "Definitions" on page 12 for the definition of Adjusted EBITDA. | |||||||||||||||||||||||||||||||||||||||||

(3) Payout Ratio (Core FFO basis) is calculated by dividing the common dividend per share by the Core FFO per share. Core FFO is a non-GAAP measure. See "Definitions" on page 12 for the definition of Core FFO. | |||||||||||||||||||||||||||||||||||||||||

(4) Payout Ratio (Core AFFO basis) is calculated by dividing the common dividend per share by the Core AFFO per share. Core AFFO is a non-GAAP measure. See "Definitions" on page 12 for the definition of Core AFFO. | |||||||||||||||||||||||||||||||||||||||||

Net Loss to NOI Reconciliations (In thousands) |  | ||||

| Nine Months Ended | Three Months Ended | ||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||

| Net loss | $ | (49,872) | $ | (27,337) | $ | (43,618) | $ | (2,611) | $ | (3,643) | $ | (3,531) | $ | (10,739) | |||||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||||||||

| Property management expense | 5,882 | 5,462 | 1,935 | 2,178 | 1,769 | 1,974 | 1,916 | ||||||||||||||||||||||||||||||||||

| General and administrative expense | 19,891 | 20,998 | 6,370 | 6,680 | 6,841 | 7,260 | 6,403 | ||||||||||||||||||||||||||||||||||

| Transformation costs | 6,339 | 6,645 | 985 | 2,454 | 2,900 | 3,041 | 2,399 | ||||||||||||||||||||||||||||||||||

| Real estate depreciation and amortization | 64,855 | 69,871 | 21,904 | 21,415 | 21,536 | 21,851 | 23,632 | ||||||||||||||||||||||||||||||||||

| Real estate impairment | 41,860 | — | 41,860 | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Interest expense | 21,043 | 18,388 | 7,418 | 6,794 | 6,831 | 6,552 | 6,582 | ||||||||||||||||||||||||||||||||||

| Loss on extinguishment of debt, net | 54 | 4,917 | — | — | 54 | — | 4,917 | ||||||||||||||||||||||||||||||||||

| Other income | (569) | (454) | — | (569) | — | (258) | (68) | ||||||||||||||||||||||||||||||||||

Total Net operating income (NOI)(1) | $ | 109,483 | $ | 98,490 | $ | 36,854 | $ | 36,341 | $ | 36,288 | $ | 36,889 | $ | 35,042 | |||||||||||||||||||||||||||

| Multifamily NOI: | |||||||||||||||||||||||||||||||||||||||||

| Same-store portfolio | $ | 89,903 | $ | 82,012 | $ | 30,336 | $ | 30,021 | $ | 29,546 | $ | 29,661 | $ | 28,264 | |||||||||||||||||||||||||||

| Acquisitions | 9,172 | 5,924 | 3,165 | 2,876 | 3,131 | 3,504 | 3,291 | ||||||||||||||||||||||||||||||||||

| Development | (168) | (71) | (56) | (54) | (58) | (57) | (52) | ||||||||||||||||||||||||||||||||||

| Non-residential | 620 | 593 | 189 | 203 | 228 | 199 | 188 | ||||||||||||||||||||||||||||||||||

| Total | 99,527 | 88,458 | 33,634 | 33,046 | 32,847 | 33,307 | 31,691 | ||||||||||||||||||||||||||||||||||

| Other NOI (Watergate 600) | 9,956 | 10,032 | 3,220 | 3,295 | 3,441 | 3,582 | 3,351 | ||||||||||||||||||||||||||||||||||

| Total NOI | $ | 109,483 | $ | 98,490 | $ | 36,854 | $ | 36,341 | $ | 36,288 | $ | 36,889 | $ | 35,042 | |||||||||||||||||||||||||||

______________________________ | |||||||||||||||||||||||||||||||||||||||||

(1) NOI is a non-GAAP measure. See "Definitions" on page 12 for the definition of NOI and reconciliation of Net loss to NOI on the current page. | |||||||||||||||||||||||||||||||||||||||||